42 price of coupon bond

Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Key Differences: Bond Price vs. Yield - SmartAsset Bond Price and Interest Rate Example. Let's say you purchase a bond from ABC Corp. that comes with a coupon rate of 5%. Three possibilities follow: The prevailing interest rate stays the same as the bond's coupon rate. The par value is set at 100, which means that buyers will pay the full price for the bond. The prevailing interest rates ...

AMAZON.COM INC.DL-NOTES 2021(21/28) Bond | Markets Insider The Amazon.com Inc.-Bond has a maturity date of 5/12/2028 and offers a coupon of 1.6500%. The payment of the coupon will take place 2.0 times per biannual on the 12.11.. At the current price of 90 ...

Price of coupon bond

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... What Is a Spot Rate? Spot rates are the prices of physical or financial assets in a transaction for immediate settlement. Spot rates of various maturity zero-coupon bonds are used to construct the term structure of interest rates. Unlike spot rates, forward rates are the agreed-upon price of an asset that is to be exchanged at some point in the future. Bond Price Calculator - Brandon Renfro, Ph.D. A bond’s coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon ...

Price of coupon bond. Bond Price Calculator - Exploring Finance Bond face value is 1000; Annual coupon rate is 6%; Payments are semiannually; What is the bond price? You can easily calculate the bond price using the Bond Price Calculator. Simply enter the following values in the calculator: Once you’re done entering the values, press on the ‘Calculate Bond Price’ button, and you’ll get the bond ... Zero Coupon Bond: Definition, Formula & Example - Video ... Invest in a reputable bond mutual fund that provides annual returns of 3%. You deem this to be an acceptable rate of return. Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5... AMAZON.COM INC.DL-NOTES 2017(17/27) Bond | Markets Insider The Amazon.com Inc.-Bond has a maturity date of 8/22/2027 and offers a coupon of 3.1500%. The payment of the coupon will take place 2.0 times per biannual on the 22.02.. At the current price of 98 ... What Is Dirty Price? The dirty price of a bond is the price of the bond that factors in accrued interest. The dirty price is what you pay when you buy a bond, and is helpful in understanding its true value. When you buy a bond between coupon dates, you need to account for any interest that has accrued. You'll typically see the clean price, which doesn't account ...

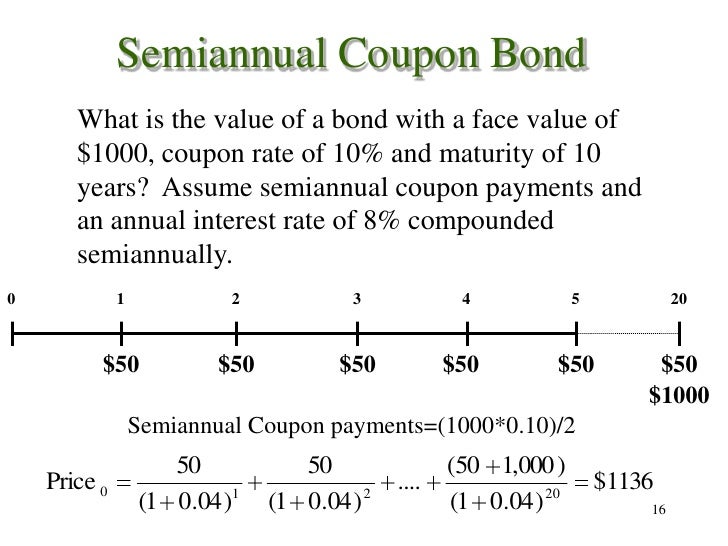

How to Calculate the Yield of a Zero Coupon Bond Using ... So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five. PRICE function (DAX) - DAX | Microsoft Docs The price per \$100 face value. Remarks. Dates are stored as sequential serial numbers so they can be used in calculations. In DAX, December 30, 1899 is day 0, and January 1, 2008 is 39448 because it is 39,448 days after December 30, 1899. The settlement date is the date a buyer purchases a coupon, such as a bond. › coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, calculation of the Coupon Bond will be as follows, So it will be – = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. Bond Pricing | Valuation | Formula | How to calculate with ... Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8 The following is the summary of bond pricing:

Yield to Maturity Calculator | Calculate YTM Determine the bond price; The bond price is the money an investor has to pay to acquire the bond. It can be found on most financial data websites. The bond price of Bond A is $980. Determine the face value; The face value is equivalent to the principal of the bond. For our example, face value = $1,000. Determine the annual coupon rate and the ... MICROSOFT CORP.DL-NOTES 2017(17/57) Bond | Markets Insider The Microsoft Corp.-Bond has a maturity date of 2/6/2057 and offers a coupon of 4.5000%. The payment of the coupon will take place 2.0 times per biannual on the 06.08.. At the current price of 110 ... Bond Valuation Definition - Investopedia Therefore, the value of the bond is $1,038.54. Zero-Coupon Bond Valuation A zero-coupon bond makes no annual or semi-annual coupon payments for the duration of the bond. Instead, it is sold at a... Quant Bonds - Between Coupon Dates - BetterSolutions.com The buyer compensates you for this by adding the accrued interest to the current price. This is the amount of the coupon payment that the holder of the bond has earned since the last coupon payment. SS - equation. Include only one of the two bracketing dates. If this is the first coupon, use the dates date instead of the previous coupon date.

bond-pricing - PyPI This mode is particularly convenient to price par bonds or price other bonds on issue date or coupon dates. For example, finding the price of a 7 year 3.5% coupon bond if the prevailing yield is 3.65% is easier in this mode as the maturity is simply given as 7.0 instead of providing a maturity date and specifying today's date.

Bond Price Calculator – Present Value of Future Cashflows ... Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero Coupon Bond Definition and Example | Investing Answers The price of a zero-coupon bond can be calculated by using the following formula: where: M = maturity (or face) value. r = investor's required annual yield / 2. n = number of years until maturity x 2. P = Price. The idea behind calculating the price of a zero coupon bond is so that you can determine the price you want to pay for the investment ...

Understanding Bond Prices and Yields - Investopedia A bond's dollar price represents a percentage of the bond's principal balance, otherwise known as par value. A bond is simply a loan, after all, and the principal balance, or par value, is the loan...

BONDS | BOND MARKET | PRICES | RATES | Markets Insider Get all the information on the bond market. Find the latest bond prices and news. ... The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as …

corporatefinanceinstitute.com › bond-pricingBond Pricing - Formula, How to Calculate a Bond's Price Bond Pricing: Coupons. A bond may or may not come with attached coupons. A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon.

Post a Comment for "42 price of coupon bond"