40 bond coupon interest rate

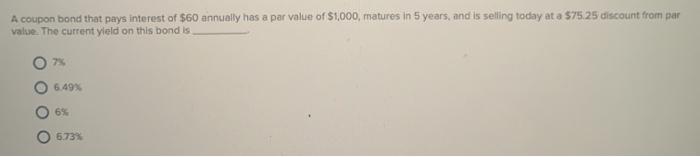

Zero Coupon Bond Questions and Answers | Study.com Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per half a year. The bond has 3 years until … Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Bond coupon interest rate

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. 2022 Corporate Bond Outlook: Focus on Income | Charles Schwab Finally, bank loans have floating coupon rates, which reduces their interest rate sensitivity. Adding it all up, bank loans have less credit risk and less interest rate risk than traditional high-yield corporate bonds, but investors aren't sacrificing much in yield for those characteristics. Coupon Rate of a Bond (Formula, Definition) | Calculate ... Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount Bond Will Be Traded At A Discount A discount bond is one that is issued for less than its face value. It also refers to bonds whose coupon rates are lower than the market interest rate and thus trade for less than their face value in the secondary market. read more.

Bond coupon interest rate. How the Coupon Interest Rate of a Bond Affects Its Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... I Bonds Are More Appealing Than Ever. Here's Why - CNET I bond interest rates are updated on the first business days of May and November. Right now, the combined interest rate on I bonds sits at 9.62% -- which is well above most savings account rates. Is coupon rate same as interest rate? Definition of 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or face value) also.Coupon rate is not the same as the rate of interest. How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers.

Relationship Between Interest Rates & Bond Prices To appeal to demand, the value of the pre-existing zero-coupon bond must lower sufficient to match the identical return yielded by prevailing rates of interest. In this occasion, the bond's worth would drop from $950 (which supplies a 5.26% yield) to roughly $909.09 (which supplies a ten% yield). Bond Yield Definition - Investopedia Bond yield is the amount of return an investor will realize on a bond, calculated by dividing its face value by the amount of interest it pays. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

Bond Price Calculator – Present Value of Future Cashflows ... Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Bond Basics: How Interest Rates Affect Bond Yields Bond prices, coupons, and yields Regardless of whether a bond is issued by a government or a corporation, the mechanics of bond pricing are the same. Bonds are issued at a specific rate of interest that the issuer will pay to investors, known as the coupon. Once issued, the coupon never changes - but prevailing interest rates can. When that ...

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

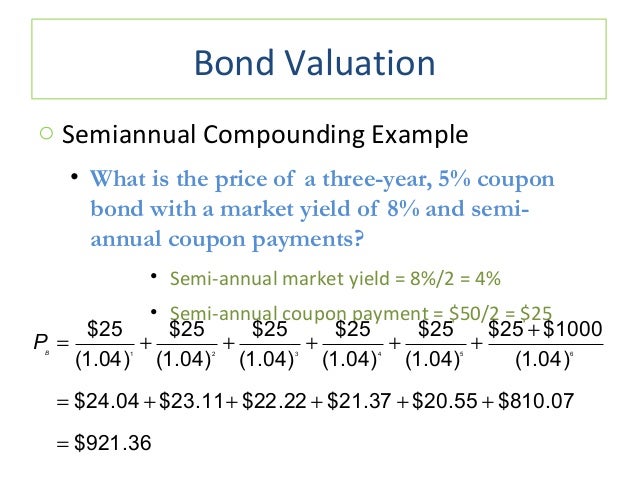

How to Calculate the Price of a Bond With Semiannual ... 24/04/2019 · The required rate of return, financially speaking, is the rate you should "require" from your bond based on comparable investments that are available. The assumption is that it's pointless to invest in a bond if you can achieve an equivalent or better return with an alternative investment. For example, if there are bonds available in the ...

Bonds and Interest Rates | FINRA.org The federal funds rate, in turn, influences interest rates throughout the country, including bond coupon rates. Another rate that heavily influences a bond's coupon is the Fed's Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. The Fed directly controls this rate.

Relationship Between Interest Rates & Bond Prices 03/06/2021 · Now that we have an idea of how a bond's price moves in relation to interest rate changes, it's easy to see why a bond's price would increase if prevailing interest rates …

Coupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of...

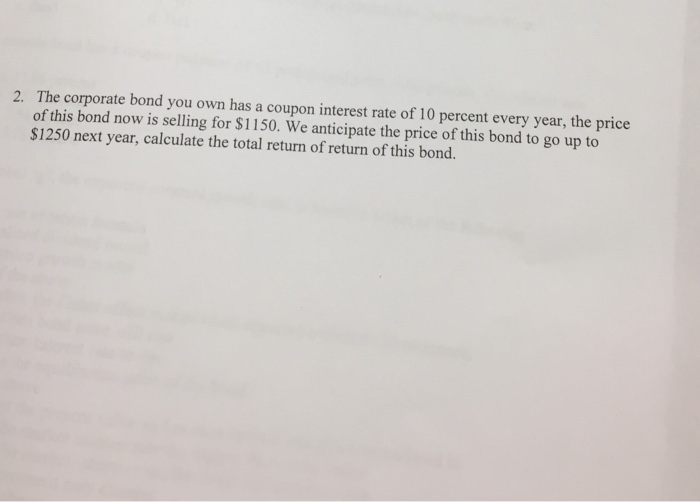

What Is Coupon Rate and How Do You Calculate It? The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons.

Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

You are considering a 30-year, $1,000 par value bond. | Chegg.com Transcribed image text: You are considering a 30-year, $1,000 par value bond. Its coupon rate is 8%, and interest is paid semiannually. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

Zero-Coupon Bond Definition - Investopedia 26/02/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Interest rate future - Wikipedia An interest rate future is a financial derivative (a futures contract) with an interest-bearing instrument as the underlying asset. It is a particular type of interest rate derivative.. Examples include Treasury-bill futures, Treasury-bond futures and Eurodollar futures.. The global market for exchange-traded interest rate futures is notionally valued by the Bank for International …

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par. Since the coupon (6%) is higher than the market interest (5%), the bond will be traded at a premium. Drivers of Coupon Rate of a Bond

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Coupon Interest and Yield for eTBs - australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

[Solved] A. Consider a 30-year U.S. corporate bond paying 7 percent coupon. The bond has 20 ...

Series I Savings Bonds Rates & Terms: Calculating Interest Rates What interest will I get if I buy an I bond now? The composite rate for I bonds issued from May 2022 through October 2022 is 9.62 percent. This rate applies for the first six months you own the bond. How do I bonds earn interest? An I bond earns interest monthly from the first day of the month in the issue date. The interest accrues (is added ...

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate is the annual amount of interest that the owner of the bond will receive. To complicate things the coupon rate may also be referred to as the ...

/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "40 bond coupon interest rate"