38 ytm zero coupon bond

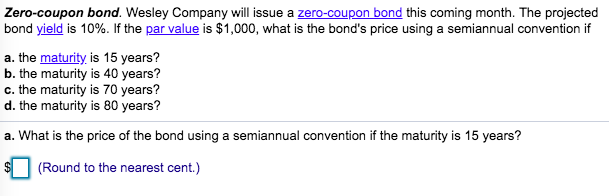

Solved What is the YTM for a zero coupon bond ($1,000 par) - Chegg Question:What is the YTM for a zero coupon bond ($1,000 par) maturing 18 months and 15 days from now selling for $900 today. Use semiannual rate approach. A. 7.19% B. 8.41% C. 6.94% D. 6.53% E. 7.81% This problem has been solved! See the answerSee the answerSee the answerdone loading Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

The yield to maturity on 1-year zero-coupon bonds is - chegg.com Finance questions and answers. The yield to maturity on 1-year zero-coupon bonds is currently 5.5%; the YTM on 2-year zeros is 6.5%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 7.5%. The face value of the bond is $100. a.

Ytm zero coupon bond

Yield to Maturity (YTM) Definition & Example - InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. Zero Coupon Bond Calculator - What is the Market Price? - Don't Quit ... What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds YTM for a zero coupon bond? | Forum - Bionic Turtle Hi David, While solving one of the questions i came to a section where I was to calculate the YTM of a zero coupon bond. i had the term and the price of the bond. Thinking that zero coupon bond has just one payment, i calculated the discount rate using term, par value and the price. To my...

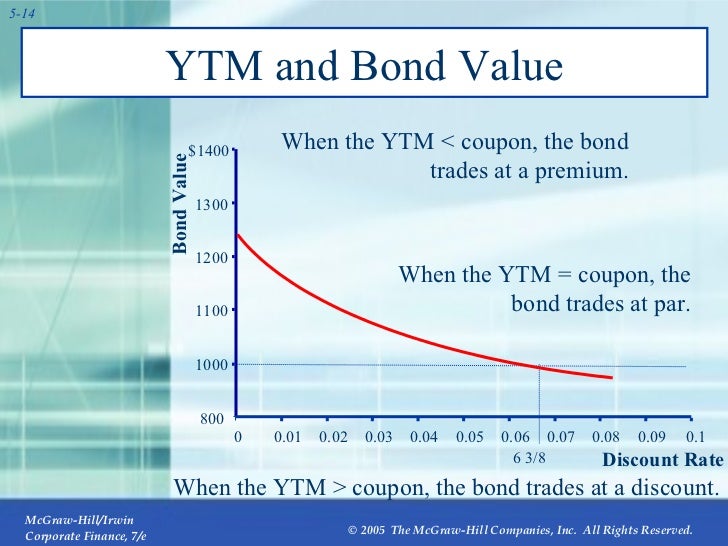

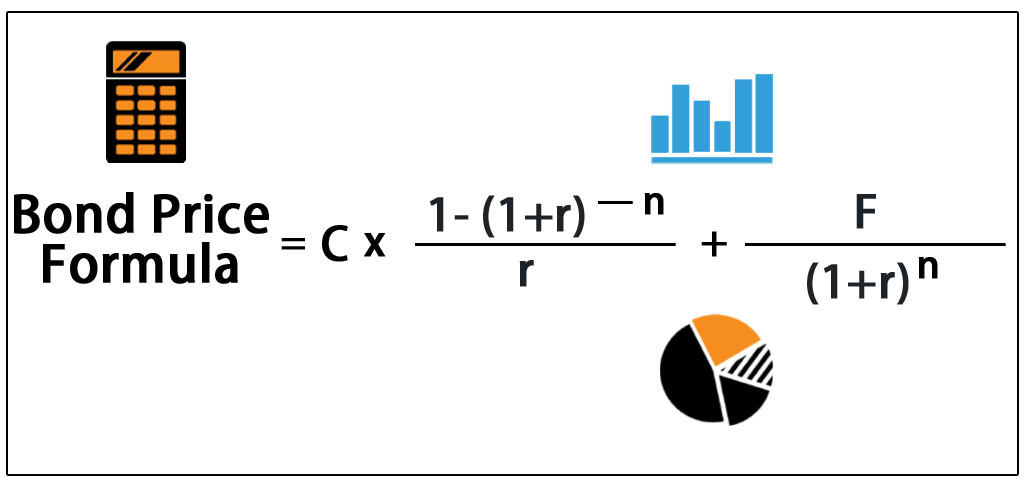

Ytm zero coupon bond. Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

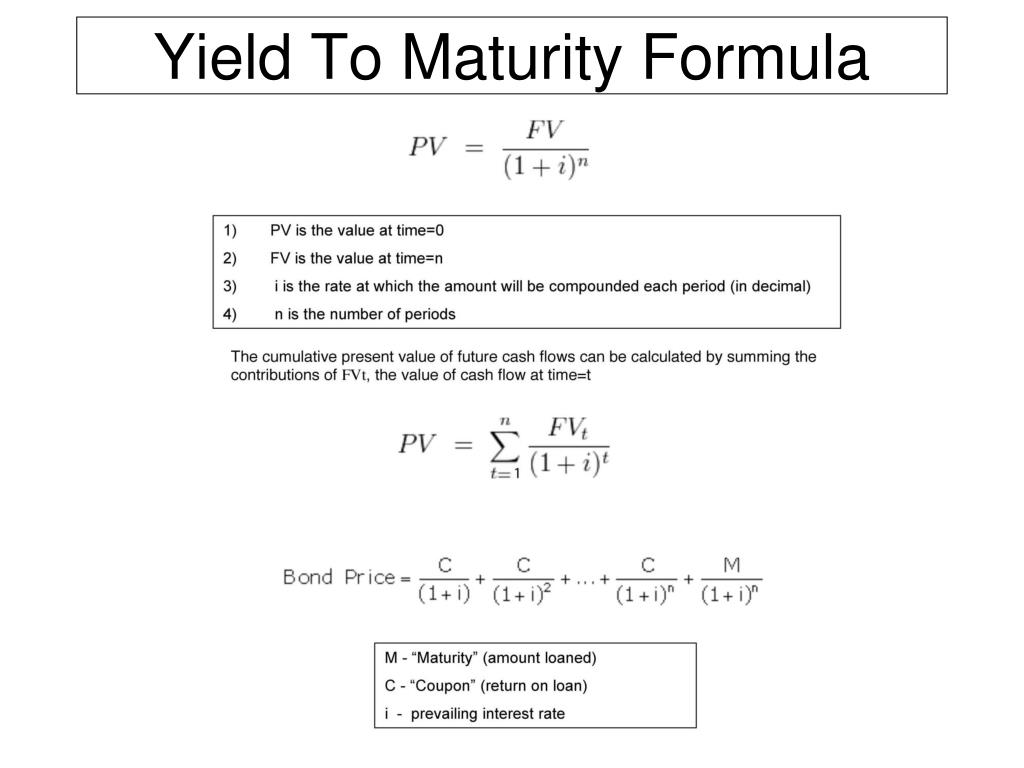

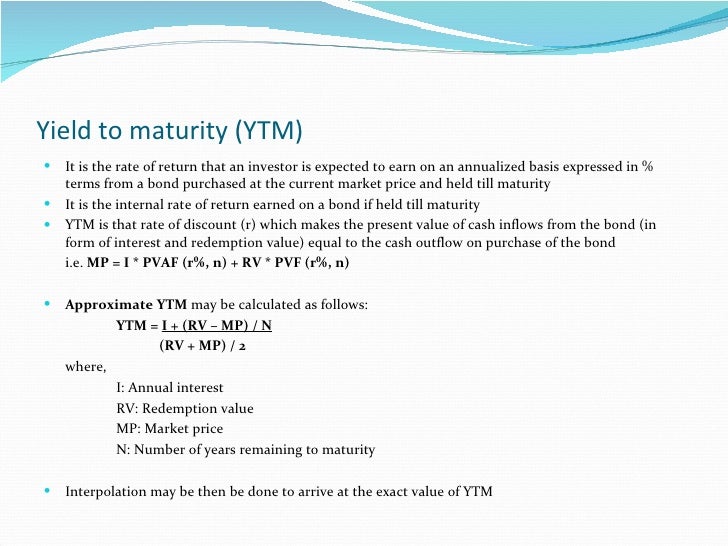

Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact yield to maturity formula are inside. ... and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Return of zero coupon bond in Excel. YTM of zero coupon bond ... - YouTube Learn how to calculate yield to maturity (YTM) of a zero coupon bond with excel. @RK varsity Solved The YTM for a zero-coupon bond is 10.50% for a 1-year - chegg.com The YTM for a zero-coupon bond is 10.50% for a 1-year bond and 11.2% for a 2-year bond. You wish to make a 1-year investment and obviously can buy the 1-year bond and hold it to maturity. Suppose, however, that you think the yield curve will remain the same throughout the future. What Is the Difference Between IRR and the Yield to Maturity? Mar 27, 2019 · Where C is the coupon interest payment, F is the face value of the bond, P is the market price of the bond, and "n" is the number of years to maturity. For example, let's say that we buy a bond ... Bond Formula | How to Calculate a Bond | Examples with Excel Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if …

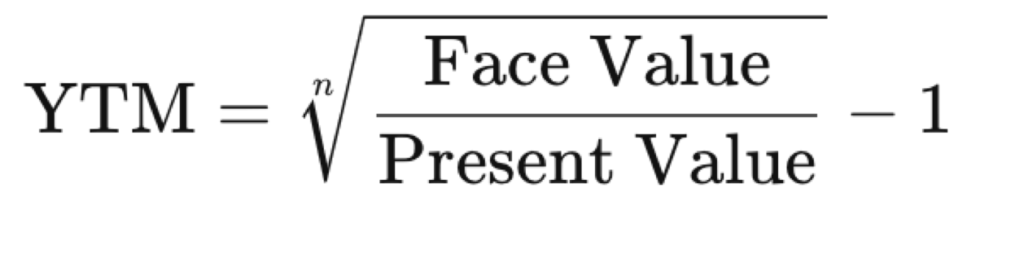

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Duration | Definition & Examples | InvestingAnswers Jan 10, 2021 · Zero-coupon bonds – which have only one cash flow – have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. 3. Yield to Maturity. The higher a bond's yield to maturity, the ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

How do I Calculate Zero Coupon Bond Yield? (with picture) - wiseGEEK The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the power of ...

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Bond (finance) - Wikipedia The yield to maturity will be realized only under certain conditions, including: 1) all interest payments are reinvested rather than spent, and 2) all interest payments are reinvested at the yield to maturity calculated at the time the bond is purchased. ... An example of zero coupon bonds is Series E savings bonds issued by the U.S. government ...

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 1000/(1+YTM)^2. The Yield to Maturity (YTM) of the bond is 24.781%. After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Calculate the YTM of a Zero Coupon Bond - YouTube This video explains how to calculate the yield to maturity (YTM) of a zero coupon bond using the lump sum formula.

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Solved . Compute the yield to maturity (YTM) of a | Chegg.com Compute the yield to maturity (YTM) of a zero-coupon bond with nine years to maturity and currently selling at 45 percent. (Price = 45 or PV = 45

What is a Zero Coupon Bond? Who Should Invest? - Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Post a Comment for "38 ytm zero coupon bond"