41 coupon vs interest rate

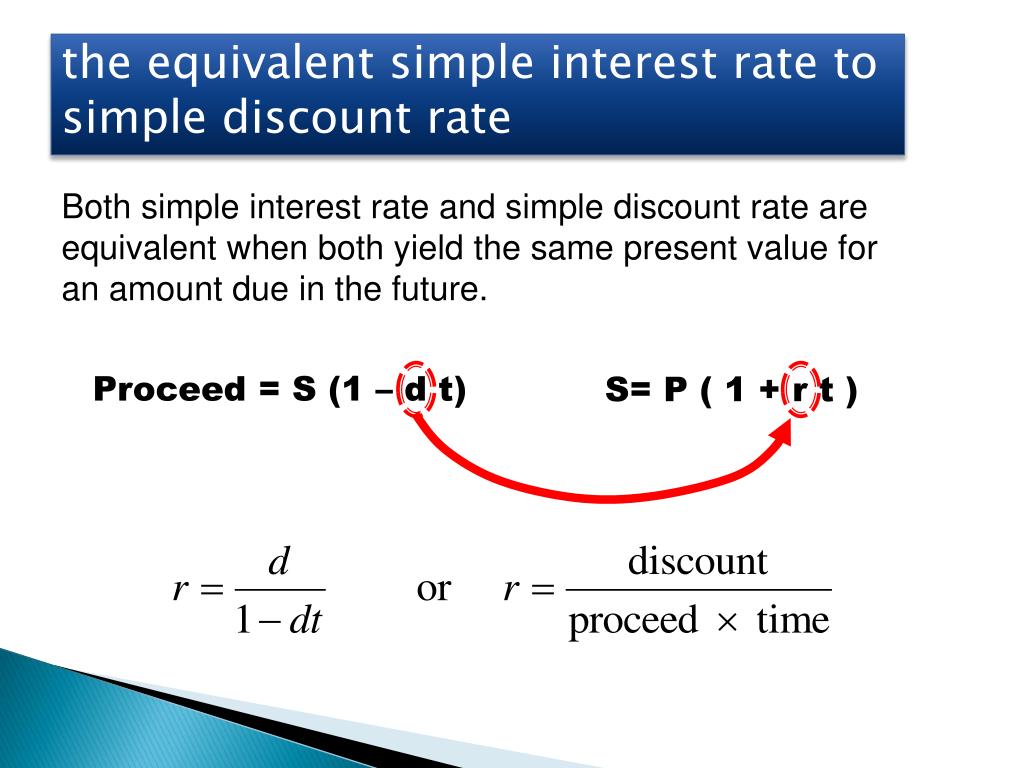

› mortgages › apr-vs-interest-rateAPR Vs. Interest Rate: What’s The Difference? – Forbes Advisor May 21, 2022 · APR, or annual percentage rate, is a calculation that includes both a loan’s interest rate and a loan’s finance charges, expressed as an annual cost over the life of the loan. In other words ... › discount-rate-vs-interest-rateDiscount Rate vs Interest Rate | 7 Best Difference (with ... The interest rate will be higher if the borrower’s profile is considered risky, the rate of interest charged on them will be on the higher side. Head to Head Comparison Between Discount Rate vs Interest Rate (Infographics) Below is the top 7 difference between Discount Rate vs Interest Rate:

› ask › answersInterest Rate vs. APR Meaning: Knowing the Difference Jul 22, 2022 · For example, if you were considering a mortgage loan for $200,000 with a 6% interest rate, your annual interest expense would amount to $12,000, or a monthly payment of $1,000.

Coupon vs interest rate

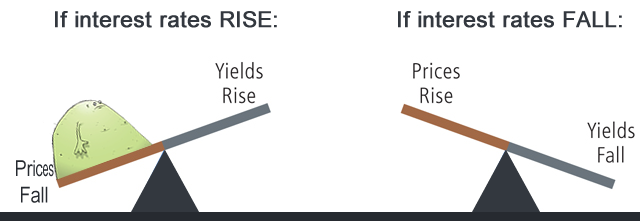

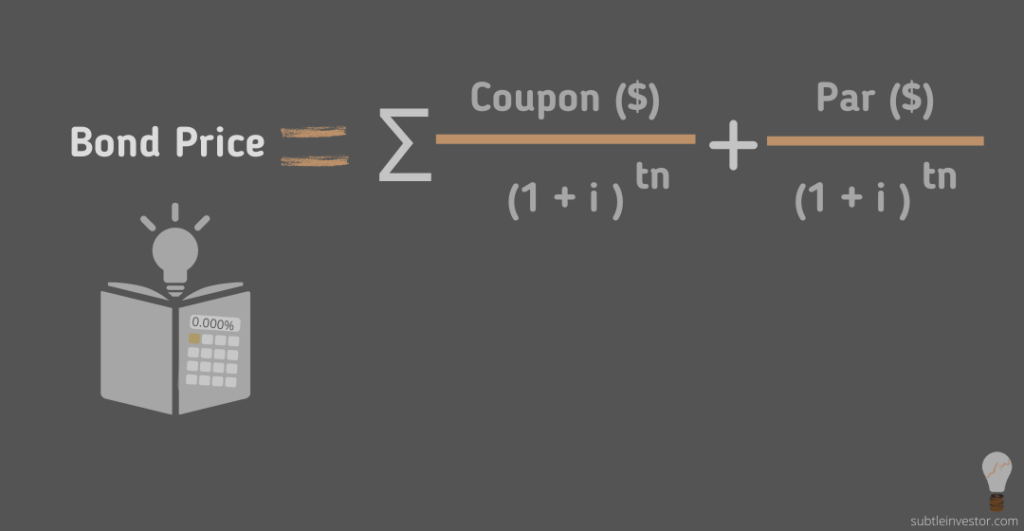

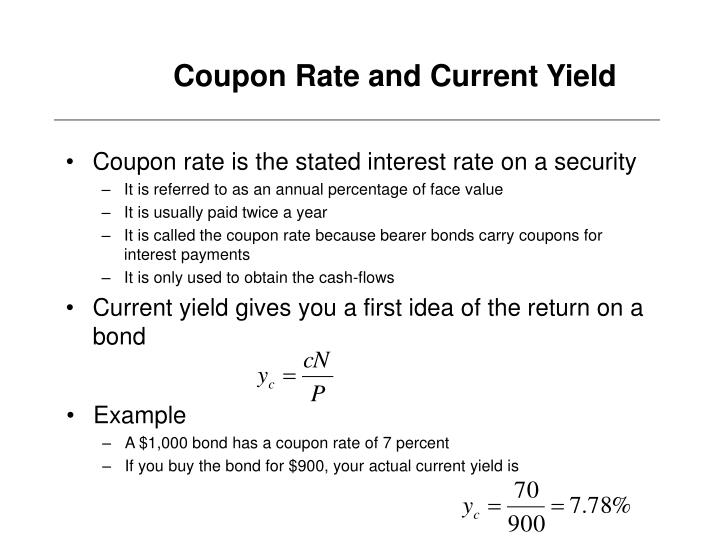

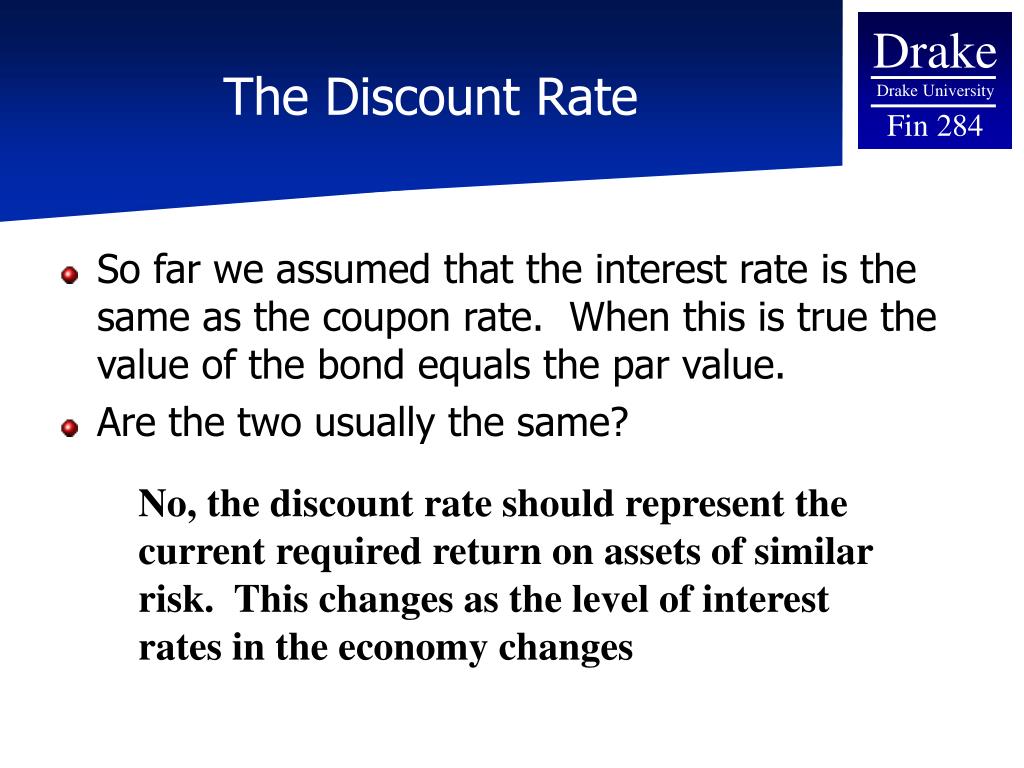

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Bond Yield Rate vs. Coupon Rate: An Overview . ... The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon vs interest rate. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ... › ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Bond Yield Rate vs. Coupon Rate: An Overview . ... The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its ...

![Interest Rate & Discount Rate Explained [VIB017] - YouTube](https://i.ytimg.com/vi/NXbv32KpcqQ/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Post a Comment for "41 coupon vs interest rate"