41 treasury bills coupon rate

Reserve Bank of India - NSDP Display 91-Day Treasury Bill (Primary) Yield: 3.39: 5.24: 5.40: 5.62: 5.56: 5.59: 182-Day Treasury Bill (Primary) Yield: 3.47: 5.75: 5.85: 5.98: 5.89: 5.96: 364-Day Treasury Bill (Primary) Yield ... Benchmarks India Private Limited (FBIL) has taken over from RBI, the computation and dissemination of reference rate for spot USD/INR and exchange rate of ... corporatefinanceinstitute.com › resourcesTreasury Bills - Guide to Understanding How T-Bills Work Jan 23, 2022 · How to Purchase Treasury Bills. Treasury bills can be purchased in the following three ways: 1. Non-competitive bid. In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. The yield that an investor receives is equal to the average auction price for T-bills sold at auction.

EGP T-Bonds Zero Coupon Monthly Average Interest Rates; EGP T-Bills Secondary Market; Time Series; Cairo Overnight Index Average - CONIA; Auctions Currently selected. Treasury Auctions T-Bills. EGP T-Bills; USD T-Bills; ... EGP Treasury Zero Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 1.5: Auction date: 22/08/2022: Issue date: 23/08/2022:

Treasury bills coupon rate

Switzerland Government Bonds - Yields Curve The Switzerland 10Y Government Bond has a 0.710% yield. 10 Years vs 2 Years bond spread is 33.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is -0.25% (last modification in June 2022). The Switzerland credit rating is AAA, according to Standard & Poor's agency. Calculating U.S. Treasury Pricing - CME Group Pricing U.S. Treasury bonds, notes and futures can look at first glance to be much different than the pricing of other investment products. ... (OTR), or most recently auctioned, 10-year note with a coupon of 2.250% and a maturity date of February 15, 2027 is currently 99-032 bid and offered at 99-03+, $10 million bid with $20 million offered. ... US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate

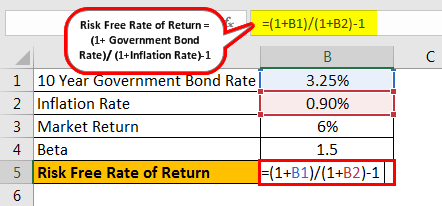

Treasury bills coupon rate. Treasury Rates, Interest Rates, Yields - Barchart.com This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least ... Reserve Bank of India - NSDP Display 91-Day Treasury Bill (Primary) Yield: 3.39: 5.24: 5.40: 5.62: 5.56: 5.59: 182-Day Treasury Bill (Primary) Yield: 3.47: 5.75: 5.85: 5.98: 5.89: 5.96: 364-Day Treasury Bill (Primary) Yield ... Benchmarks India Private Limited (FBIL) has taken over from RBI, the computation and dissemination of reference rate for spot USD/INR and exchange rate of ... Cash Management Bill (CMB) Definition - Investopedia According to the Treasury, the 17-week CMB has been a regular offering since April 2020. Weekly issues have ranged in size from $30 billion to $40 billion. The department relied heavily on these... Interest Rates - YCharts The ECB estimates zero-coupon yield curves and derives forward and par yield curves from that data. The Euro Yield Curves report contains data based on AAA-rated Eurozone central government bonds as well as data based on all bonds. ... These rates include Treasury Bills and medium- and long-term government bonds. Major Spain Interest Rates ...

Weekly Treasury Forecast, August 19, 2022: Negative 2-Year/10-Year ... This week's simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. There is a 28.65% probability that the 3-month yield falls in this... How Does an Investor Make Money On Bonds? The interest paid on a bond may be pre-set or may be based on prevailing interest rates at the time it matures. For instance, if you invested $1,000 in a 10-year bond with a coupon rate of 4%, the... Treasury Approves Four Additional State Plans to Support Underserved ... Colorado, Oregon, New York, and Montana are approved for $750 million to support investments in small business WASHINGTON — Today, the U.S. Department of Treasury announced an additional group of four state plans approved under the State Small Business Credit Initiative (SSBCI) for up to $750 million in funds to expand access to capital for small businesses. Treasury has announced more than ... Government bags ₧162.72B from sale of RTBs - BusinessMirror The latest RTB offering fetched a coupon rate of 5.75 percent during the rate-setting auction, higher than the benchmark secondary market rates for the 5-year and 6-year tenors at 5.434 percent ...

Zambia Government Bonds - Yields Curve The Zambia 10Y Government Bond has a 26.250% yield. Central Bank Rate is 9.00% (last modification in February 2022). The Zambia credit rating is SD, according to Standard & Poor's agency. Residual Maturity Zambia Yield Curve - 16 Aug 2022 Zambia Government Bonds Zambia (16 Aug 2022) 1M ago 6M ago 10Y 24% 25% 26% 27% 28% Highcharts.com ycharts.com › indicators › 10_year_treasury_rate10 Year Treasury Rate - YCharts Aug 16, 2022 · Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.98%, compared to 2.88% the previous market day and 1.24% last year. U.S. Treasury Bond Overview - CME Group Time & Sales. Specs. Margins. Calendar. US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. U.S. 3 Month Treasury Bill Overview (TMUBMUSD03M) | Barron's U.S. 3 Month Treasury Bill Tullett Prebon Watchlist market closed 2.671 % TMUBMUSD03M 0.073 Aug 19, 2022 4:56 p.m. EDT Real Time Quote Key Data Open2.666% Day Range2.618 - 2.671 52 Wk Range0.020 -...

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 2 days ago, on 19 Aug 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

The Fed - Commercial Paper Rates and Outstanding Summary - Federal Reserve Data as of August 19, 2022 Posted August 22, 2022. The commercial paper release will usually be posted daily at 1:00 p.m. However, the Federal Reserve Board makes no guarantee regarding the timing of the daily posting. This policy is subject to change at any time without notice.

› ask › answersHow Are Treasury Bills (T-Bills) Taxed? - Investopedia Jul 14, 2022 · Tax Rate of Treasury Bills The interest earned by a T-bill is taxable as investment income in the year the bill matures. It must be reported on your federal tax return , Form 1040, and is taxed at ...

scripbox.com › pf › treasury-billsTreasury Bills - Meaning, Types, Yield Calculation & How to Buy? Sep 10, 2020 · Limitations of Treasury Bills. Compared to other stock market investment tools, treasury bills yield lower returns as they are government-backed debt securities. Treasury bills are zero-coupon bonds, i.e. no interest is paid on them to investors. They are issued at a discount and redeemed at face value.

Bank of Canada Holdings - Bank of Canada Bonds for which FLT is indicated as the coupon rate have a variable coupon rate that changes every quarter. As Of Date: 2022-08-19. Government of Canada treasury bills. Maturity ISIN Par Value Of Which on Repo; 0: 0: Government of Canada Bonds. Maturity Coupon Rate ISIN Par Value Of Which on Repo; 2022-09-01: 1.000: CA135087G732: 6,795,277,000: ...

Types of Bonds to Invest In | Northwestern Mutual Coupon Rate: The coupon rate communicates how much income a bond generates for the bondholder, typically expressed as an annual rate. It is also known as the bond's interest rate. ... Treasury Bills: Treasury bills are a form of short-term debt with a maturity up to one year. Treasury Notes: Treasury notes mature in either two, three, five ...

Daily Treasury Yield Curve Rates - YCharts Daily Treasury Yield Curve Rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the ...

Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market.

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

How to Invest in Treasury Bonds - The Motley Fool Not surprisingly, Treasury bills usually pay the lowest relative rates of all the various Treasury securities. As of this writing in August 2021, rates offered at recent auctions ranged from 0.045%...

› treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury Bills. Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. Treasury bills are sold out at a discounting price, and it did not pay any interest. Treasury Bills is also called as T-Bills. A treasury bill is only typed instrument which is found in both capital and money market.

US 10 year Treasury Bond, chart, prices - FT.com How a 20-year-old student made $110mn riding the meme stock wave Aug 22 2022; Global scope of EU's greenwashing crackdown spooks Wall Street Aug 22 2022; Back to nature: why employers are sending staff on environmental retreats Aug 22 2022; Did the Fed's preferred inflation gauge ease last month?

Remarks by Deputy Secretary of the Treasury Wally Adeyemo at the Indian ... Remarks as delivered It's great to be at the renowned IIT Bombay, and especially at the Society For Innovation and Entrepreneurship. This incubator, and the students and entrepreneurs here today, represent the incredible dynamism of the Indian economy - a dynamism that has helped launched leading global brands and powered India's remarkable economic trajectory. Looking at some of the ...

US Treasury Bond Rates / Interest Rate History Chart - CrystalBull.com US Treasury Bond Rates Chart This chart shows the 30 Day Treasury Bill, 3 Month Treasury Bill, 10 Year Treasury Note, and 30 Year Treasury Bond, with Yield Curve, 3 Month CD's, and CPI, in relation to the S&P 500. Treasury Bills, Notes, and Bonds (aka T-Bills, T-Notes, T-Bonds) are safe, competitive investments vis-a-vis the stock market.

Post a Comment for "41 treasury bills coupon rate"