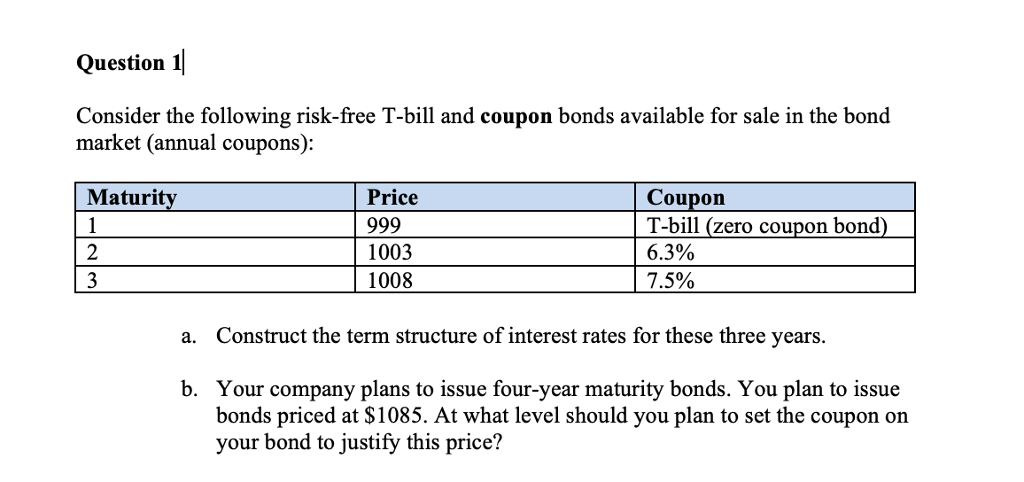

40 zero coupon bonds risk

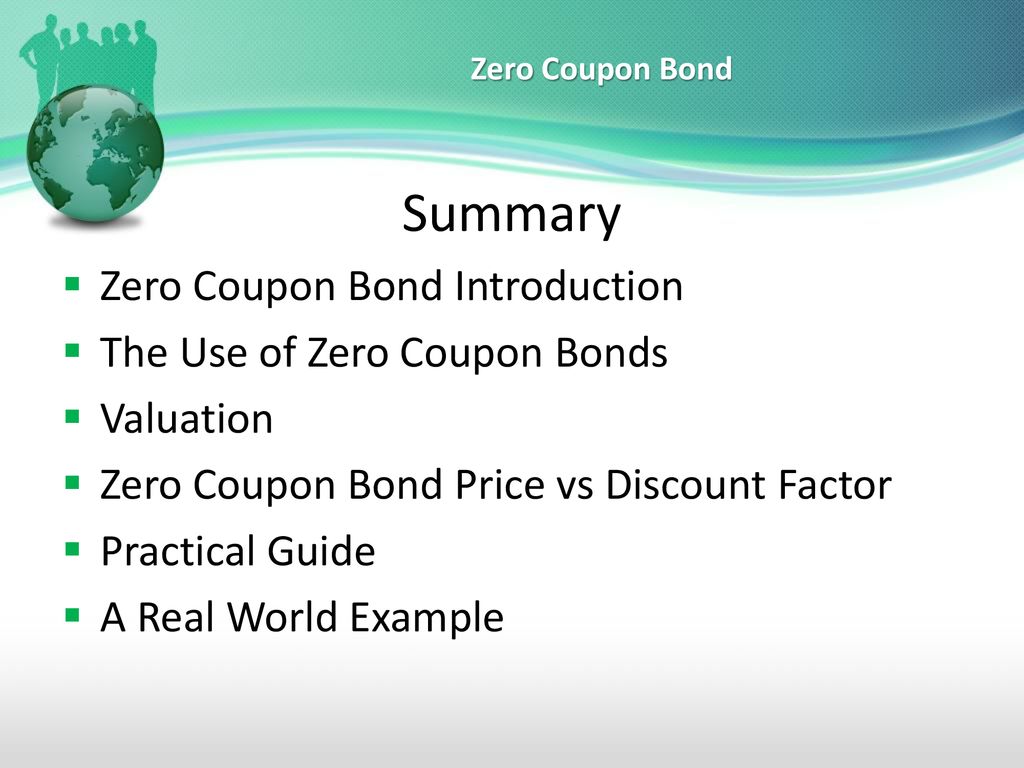

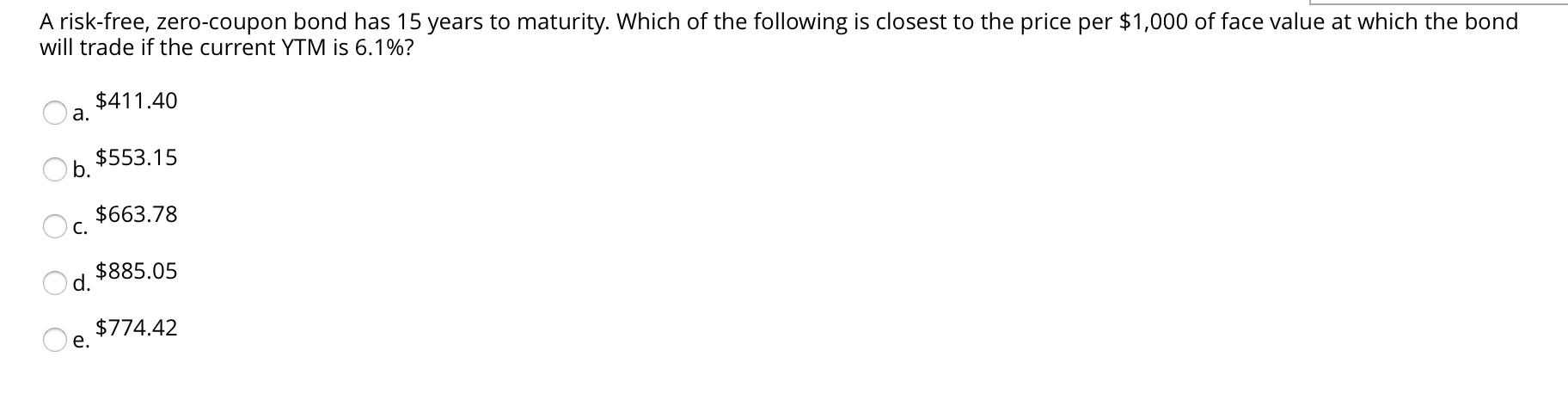

What Is a Zero-Coupon Bond? Definition, Advantages, Risks 28.07.2022 · As a result, zero-coupon bond prices are more volatile — subject to greater swings when interest rates change. You have to pay taxes on income you don't get Even though … Zero-Coupon Bond: Definition, How It Works, and How …

What Are Zero Coupon Bonds And Their Risks- Tavaga What is a Zero-Coupon Bond? Zero-coupon bond or ZCB is a financial instrument that does not pay any interest or coupon rate but is, instead, issued at a deep discount and is …

Zero coupon bonds risk

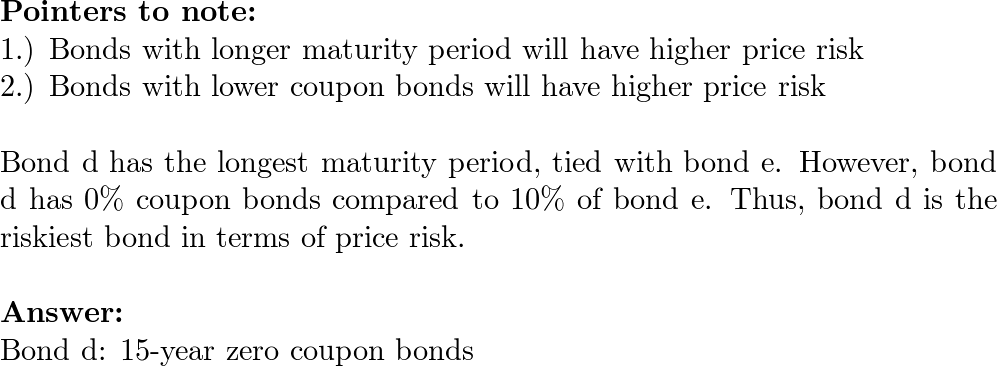

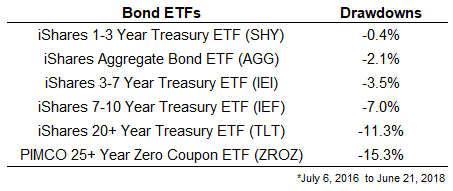

Mapping Zero-coupon Bonds to Risk Factors - Finance Train The first coupon is sensitive to the 6-month interest rate, the next coupon is sensitive to the one-year interest rate, and the last (10th) payment will be sensitive to the 5-year zero … Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money … Zero-Coupon Bond - Definition, How It Works, Formula

Zero coupon bonds risk. Zero-Coupon Bonds: Characteristics and Examples - Wall … Zero-coupon bonds, also known as “discount bonds,” are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 “Premium” (Trading Above … Advantages and Risks of Zero Coupon Treasury Bonds 25.06.2013 · Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros... The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will … cbe.org.eg › AuctionsEGPTBondsZeroCouponEGP T-Bonds Zero Coupon Mar 10, 2022 · Risk Management and Information Security; Internal Audit; ... EGP Treasury Zero Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 1.5:

Zero Coupon Bond - (Definition, Formula, Examples, … Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other … en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Zero-Coupon Bond - Definition, How It Works, Formula Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money …

Mapping Zero-coupon Bonds to Risk Factors - Finance Train The first coupon is sensitive to the 6-month interest rate, the next coupon is sensitive to the one-year interest rate, and the last (10th) payment will be sensitive to the 5-year zero …

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)

Post a Comment for "40 zero coupon bonds risk"