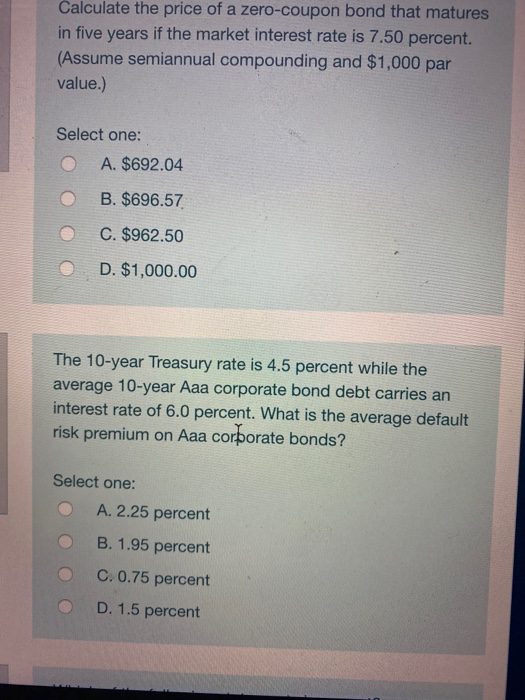

42 calculate price zero coupon bond

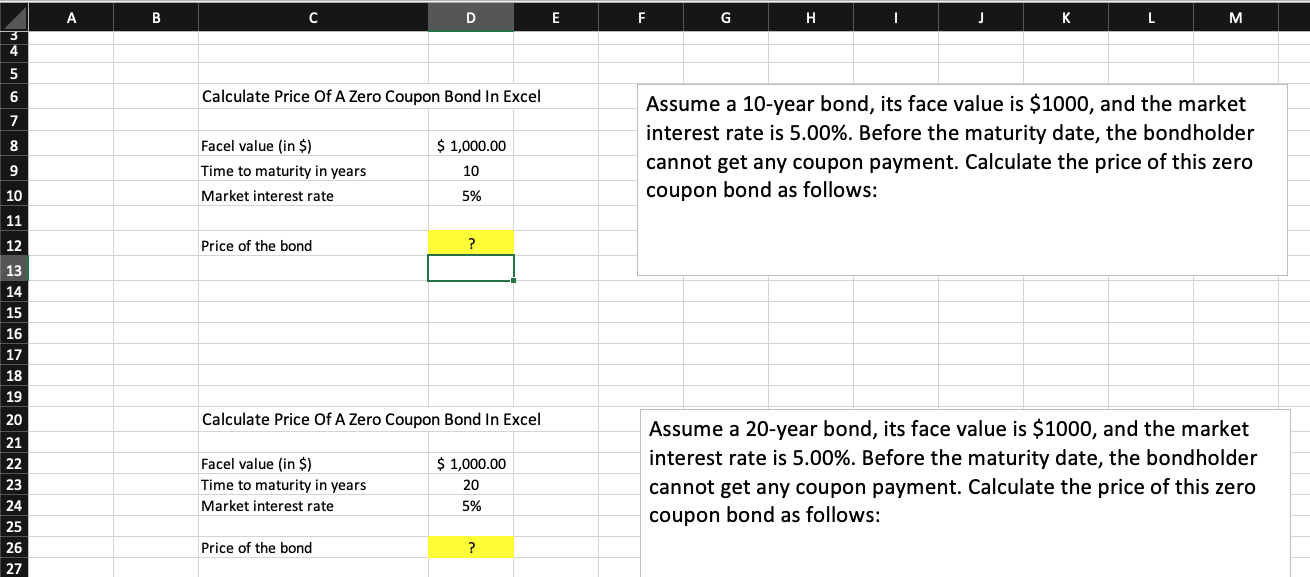

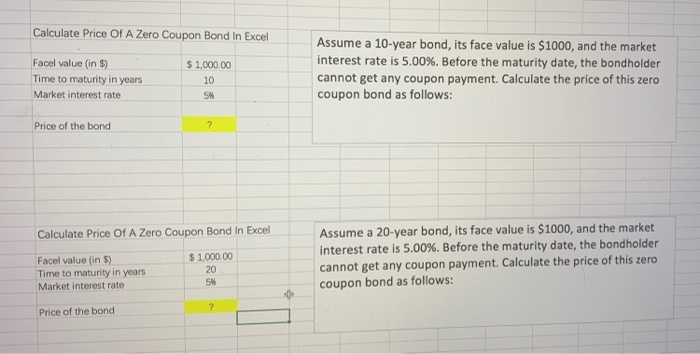

What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. › documents › excelHow to calculate bond price in Excel? - ExtendOffice For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of this zero coupon bond as follows:

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Jul 16, 2019 · n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751) As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to ...

Calculate price zero coupon bond

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. ... per year. If it only pays out at maturity try the zero coupon bond calculator, ... dirty price is very simple to calculate - you merely calculate the value of the clean price and add the ... How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. How do you calculate the price of a zero coupon bond? The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2.

Calculate price zero coupon bond. How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel; Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get ... Zero Coupon Bond Calculator - MiniWebtool About Zero Coupon Bond Calculator . The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches ... Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Zero Coupon Bond Value Formula: How to Calculate Value of Zero Coupon Yield to maturity for zero-coupon bonds is calculated as: YTM = \sqrt[n]{ \frac{Face\;value}{Current\;price} } - 1 Example of YTM of a zero-coupon bond calculation. Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is ...

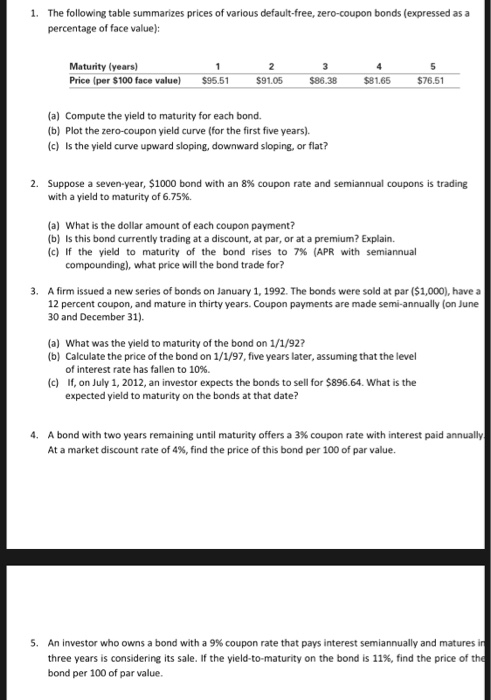

Calculate bond value with discount rate - ztmsw.abedini.info Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · In addition, the discount rate used to calculate the bond's price increases. For these two reasons, the bond's price falls. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income. › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Solution In class assignment 2-Fina4121.docx - 1) Calculate... Lucia just bought two coupon bonds, one with a face value of $1,000 and the other with a face value of $5,000. Both bonds have a coupon rate of 5% and sold at par today. Calculate both bonds´ current yield and both bonds rate of return if Lucia is able to sell these bonds one year later for $100 more of the buying price.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. F = the face value, or the full value of the bond. P = the price the ... Let's take a simple example to understand how YTM is calculated. Consider a $1,000 par bond, with 8% coupon and 7 years to maturity. The price of the bond is $1,112.96. Assume that the bond pays coupon semi-annually. C = $40. N = 2 x 7 = 14. M (face value) = $1,000. P = $1,112.96. Plugging all these numbers in the above equation, we calculate.... › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751) As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

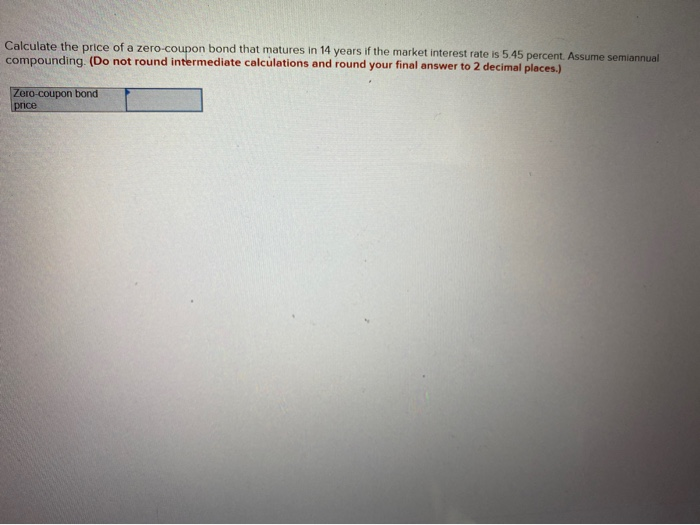

Solved Calculate the price of a zero coupon bond that | Chegg.com View the full answer. Calculate the price of a zero coupon bond that matures in 18 years if the market interest rate is 5.5 percent. Assume par value of $2,000 and semiannual compounding. Round your answer to two decimal places and enter with out any sign. For a bond selling at Par Value, the Coupon Rate = Yield to Maturity.

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Zero Coupon Bond: Formula & Examples - Study.com To calculate the current price or the present value of zero-coupon bonds, the formula for yearly stated discount rates is given as such: PV = M / ((1+i) ^ n) Where:

› knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Success Essays - Assisting students with assignments online Calculate the price. Type of paper. Academic level. Deadline. Pages (275 words) ... The further the deadline or the higher the number of pages you order, the lower the price per page! We don't juggle when it comes to pricing! Unlimited Revisions. Revisions are made for you at no charge. Make a revision and communicate with your writer exactly ...

Our free online - nsrg.mgok-tuliszkow.pl In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond Price = current price of the bond. Face Value = amount paid to the bondholder at maturity. Coupon = periodic coupon payment..

How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples)

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

Zero Coupon Bond Calculator - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01

Our free online - axy.alteregofit.pl The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find. Pricing of a bond or bond valuation is the determination of the fair value or fair price ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Formula for Zero Coupon Bond Price : A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n Where, P = Zero-Coupon Bond Price M = Face value at maturity or face value of bond r = annual yield or rate

› coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

How do you calculate the price of a zero coupon bond? The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2.

How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures.

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. ... per year. If it only pays out at maturity try the zero coupon bond calculator, ... dirty price is very simple to calculate - you merely calculate the value of the clean price and add the ...

Post a Comment for "42 calculate price zero coupon bond"