43 coupon rate for bonds

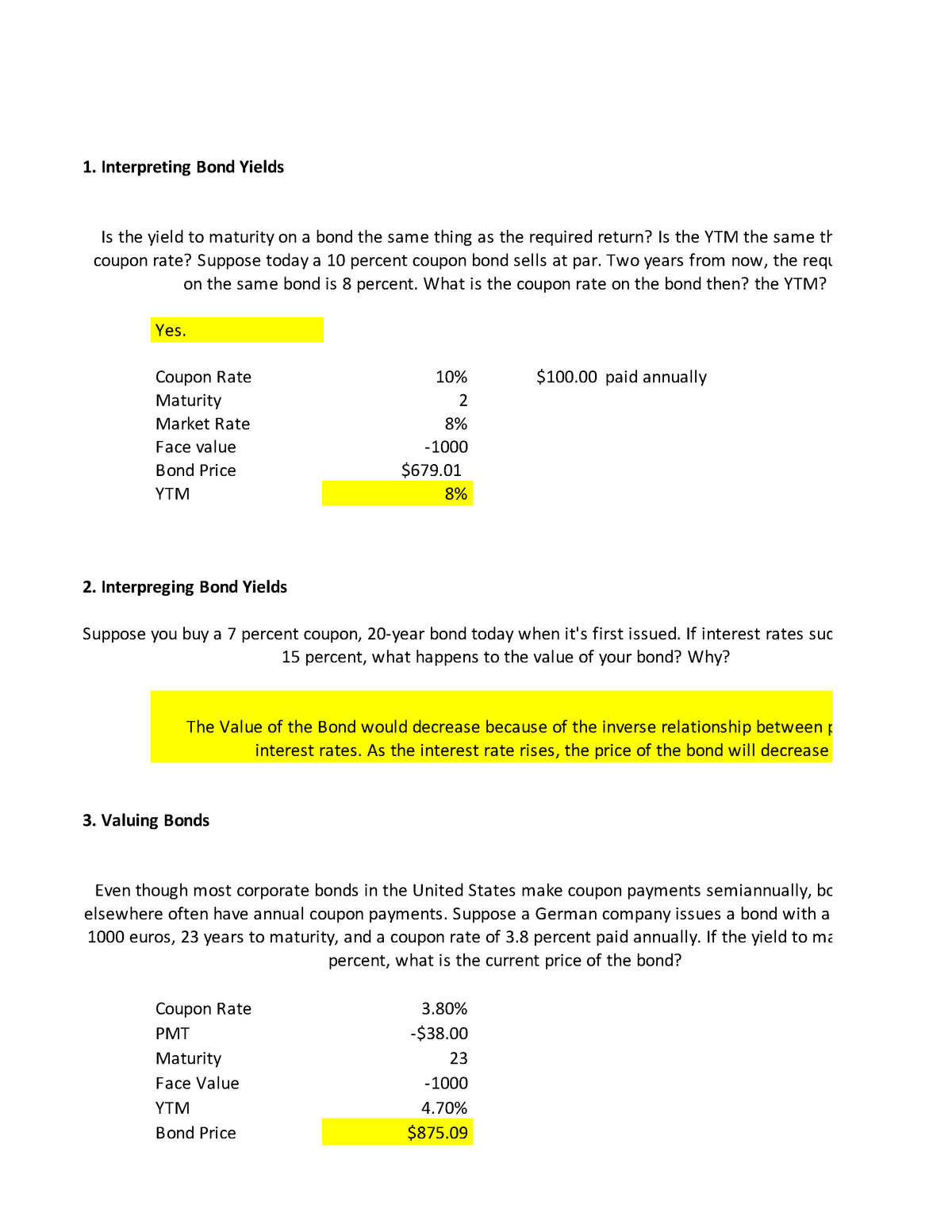

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › terms › zZero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Bonds - Overview, Examples of Government and Corporate Bonds A bond with a 5.5% yield is offering a 6% coupon rate. Will this bond's price be higher or lower than the principal? Higher, because it's a premium bond (investors will pay a higher price for the higher rate). Government Bonds.

Coupon rate for bonds

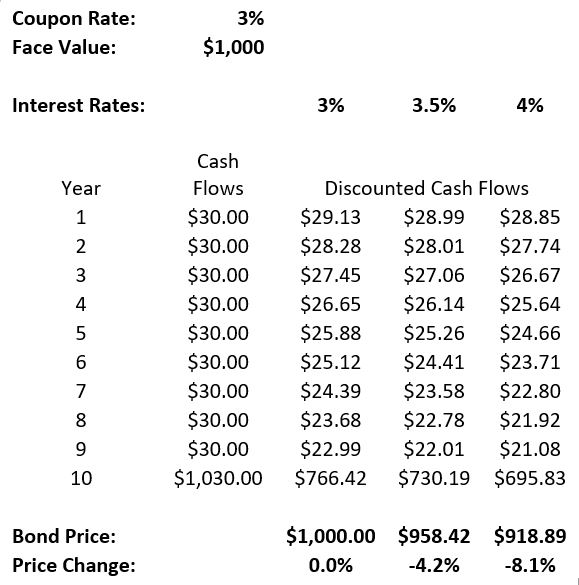

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ... Investor BulletIn Interest rate risk — When Interest rates Go up ... For example, imagine one bond that has a coupon rate of 2% while another bond has a coupon rate of 4%. All other features of the two bonds—when they mature, their level of credit risk, and so on—are the same. If market interest rates rise, then the price of the bond with the 2% coupon rate will fall more than that of the bond with the 4% Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia This means a $1,000 corporate bond that has a fixed 6% coupon pays $60 a year for the duration of the bond. Most interest payments are made semiannually. So in this example, investors would likely ...

Coupon rate for bonds. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ... Bonds | FINRA.org Another rate that heavily influences a bond's coupon is the Fed's Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. The Fed directly controls this rate. Say the Fed raises the discount rate by .5 percent. The next time the U.S. Treasury holds an auction for new Treasury bonds, it ... I Bonds Rates Will Fall to 6.48% in November 2022 Using the formula below, we can determine the minimum rate an I Bond buyer would get starting in May 2022: Total rate = Fixed rate + 2 x Semiannual inflation rate + (Semiannual inflation rate X Fixed rate) Total rate = 0.000 + 2 x 4.81 + (4.81 x 0) Total rate = 9.62%. Earning 9.62% is a heck of a terrific deal!

Corporate Bond Valuation - Overview, How To Value And Calculate Yield 5% coupon rate ($50 coupon payments paid annually) 60 payout ratio ($600 default payout) 10 probability of default; ... To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. Fixing of coupon rates - Nykredit Realkredit A/S Effective from 11 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing. The new coupon rates will ... Bond Market Pricing In Things It Doesn't Necessarily Expect to See And even while 10yr yields over 4% may not make too much logical sense (if we think about the implications over 10 years of a 5% Fed Funds Rate by mid-2023), the path of least resistance for the ... Fixing of coupon rates - Nykredit Realkredit A/S Effective from 12 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing. The new coupon rates will ...

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 4.022% yield. 10 Years vs 2 Years bond spread is -47.2 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Current 5-Years Credit Default Swap ... AMAZON.COM INC.DL-NOTES 2017(17/27) Bond - Insider The payment of the coupon will take place 2.0 times per biannual on the 22.02.. At the current price of 92.72 USD this equals a annual yield of 4.98%. The Amazon.com Inc.-Bond was issued on the 8 ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. HDB to issue $800 mil in five-year green senior bonds with 4.09% p.a ... The bonds, which have a coupon rate of 4.09% per annum (p.a.), will come with an upsize option that's said to be capped at $1.2 billion, according to Bloomberg. The fixed-rate, senior unsecured bonds are offered in denominations of $250,000 and have a settlement date of Oct 26 and will mature five years later on Oct 26, 2027.

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. That ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase “coupon rate” for two reasons.

Callable Bond - Definition, How It Works, and How to Value ABC Corp. issues bonds with a face value of $100 and a coupon rate of 6.5% while the current interest rate is 4%. The bonds will mature in 10 years. However, the company issues the bonds with an embedded call option to redeem the bonds from investors after the first five years. If interest rates have declined after five years, ABC Corp. may ...

Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Also, it depends on the par value, that is, the face ...

Guide to Floating Rate Bond ETF Investing - zacks.com The median Federal Funds rates are now projected to be 4.4% for 2022 (from 3.4% projected in June). The same is projected to be 4.6% (from 3.8% in June) for 2023 and 3.9% (from 3.4% in June) for ...

Fixing of coupon rates - Nykredit Realkredit A/S The new coupon rates will apply from 20 October 2022 to 20 January 2023: Uncapped bonds DK0009521924, (SNP), maturity in 2023, new rate as at 20 October 2022: 2.6570% pa

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 3 hours ago, on 18 Oct 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

Par Bond - Overview, Bond Pricing Formula, Example Example 3: Par Bond. Consider a bond with a 5-year maturity and a coupon rate of 5%. The market interest rate is 5%. For the bond above, the coupon rate is equal to the market interest rate. In such a scenario, a rational investor would only be willing to purchase the bond at par to its face value because its coupon return is the same as the ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Vodafone Idea to raise Rs 1,600 cr debt from vendor ATC Vodafone Idea (VIL) will raise the amount through equity convertible debt bonds that carry a coupon rate of 11.2 per cent per annum payable every six months during its term.

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... Rarely seen: High real yield, high coupon rate, discount to par value. By David Enna, Tipswatch.com. ... I have been arguing that the I Bond's fixed rate should rise, since real yields of 5-year and 10-year Treasury Inflation Protected Securities are now highly positive, 1.83% for the 5 year and 1.63% for the 10 year. In fact, the 5-year real ...

Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia This means a $1,000 corporate bond that has a fixed 6% coupon pays $60 a year for the duration of the bond. Most interest payments are made semiannually. So in this example, investors would likely ...

Investor BulletIn Interest rate risk — When Interest rates Go up ... For example, imagine one bond that has a coupon rate of 2% while another bond has a coupon rate of 4%. All other features of the two bonds—when they mature, their level of credit risk, and so on—are the same. If market interest rates rise, then the price of the bond with the 2% coupon rate will fall more than that of the bond with the 4%

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "43 coupon rate for bonds"