39 calculate coupon rate in excel

Rate of Return Formula | Calculator (Excel template) - EDUCBA Now, he wants to calculate the rate of return on his invested amount of $5,000. As we know, Rate of Return = (Current Value – Original Value) * 100 / Original Value. Put value in the above formula. Rate of Return = (10 * 1000 – 5 * 1000) * 100 / 5 *1000; Rate of Return = 100%; Rate of return on shares is 100%. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations.

› capitalization-rate-formulaCapitalization Rate Formula | Calculator (Excel template) Capitalization rate should not be a single factor in estimating whether a property is worth investing in. Recommended Articles. This has been a guide to Capitalization Rate formula. Here we discuss How to Calculate Capitalization Rate along with practical examples. We also provide a Capitalization Rate Calculator with downloadable excel template.

Calculate coupon rate in excel

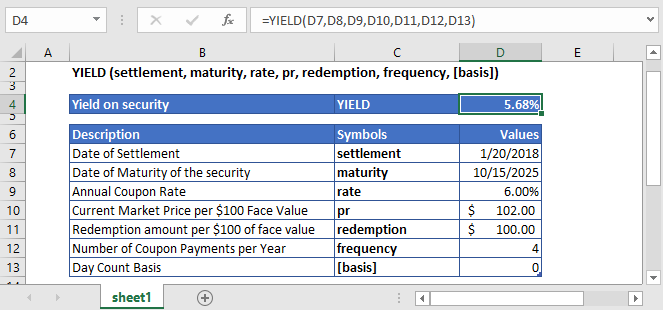

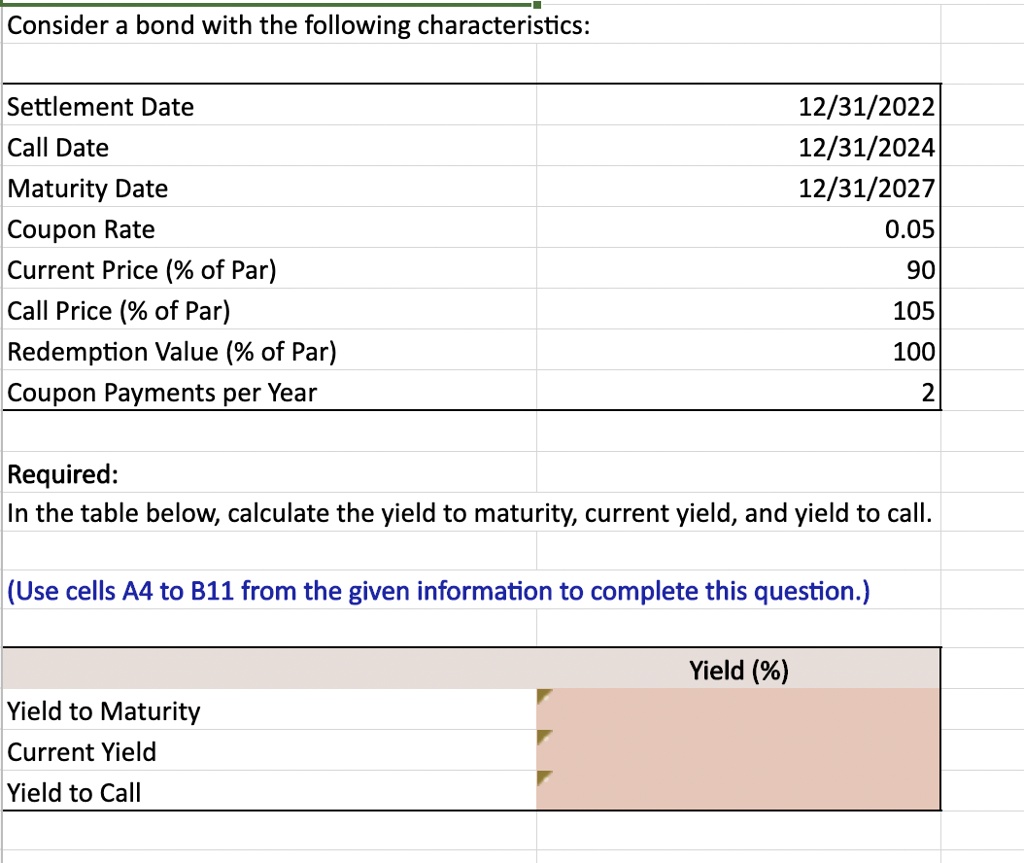

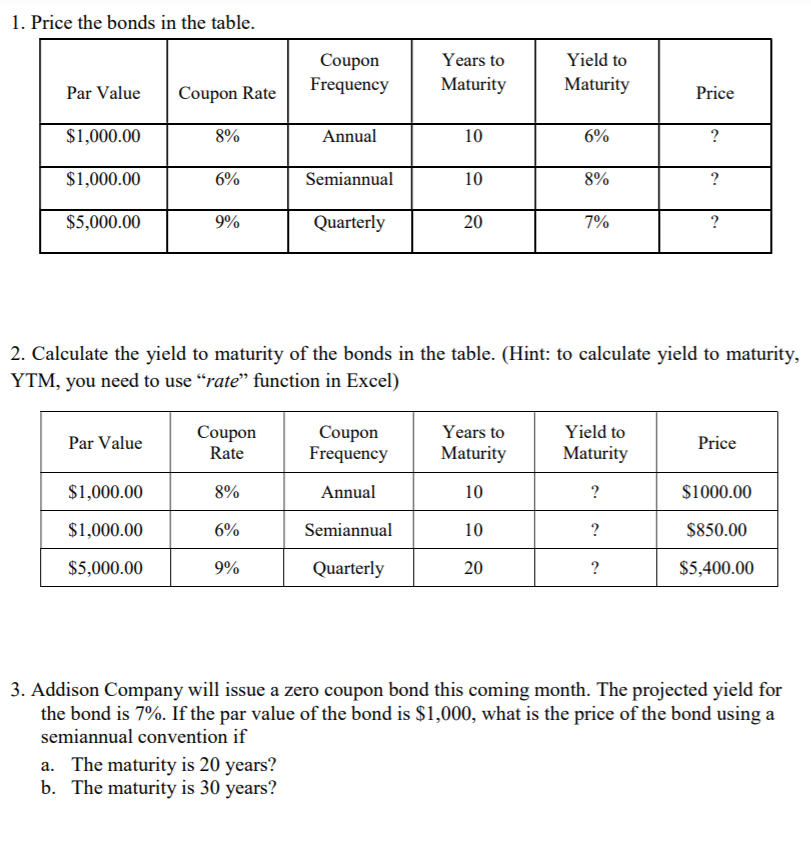

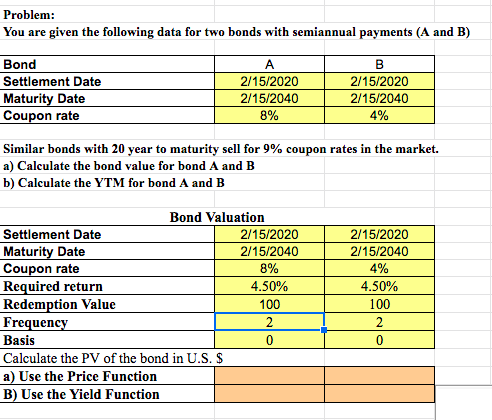

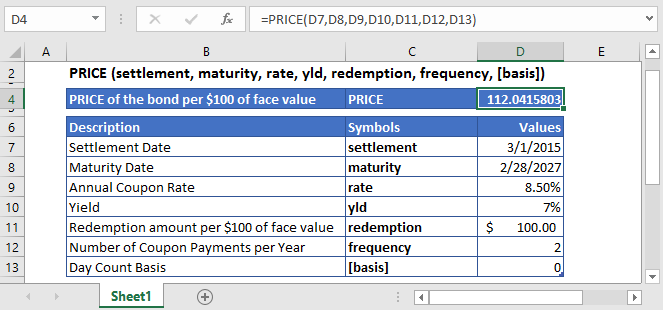

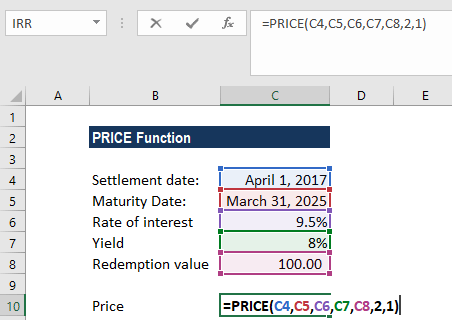

Calculate the Interest or Coupon Payment and Coupon Rate of a Bond ... Microsoft Office Excel: Calculate the Interest or Coupon Payment and Coupon Rate of a Bond: 4:50: Microsoft Office Excel: Calculate the Length (Years to Maturity) and Number of Periods for a Bond: 5:04: Microsoft Office Excel: Calculate the Present Value of a Bond with Semiannual or Quarterly Interest Payments: 12:56: Microsoft Office Excel Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2.

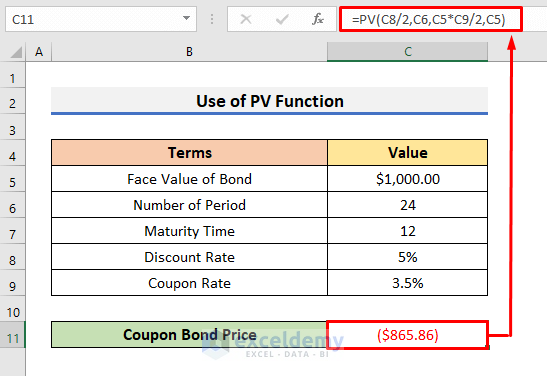

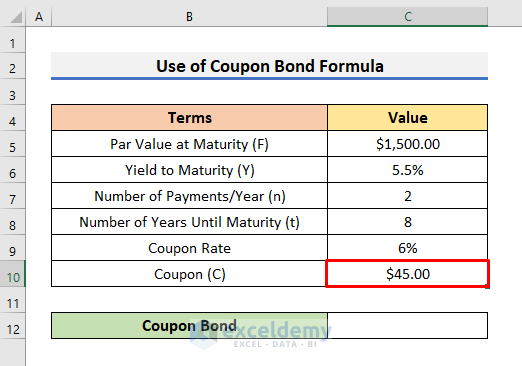

Calculate coupon rate in excel. How to calculate Spot Rates, Forward Rates & YTM in EXCEL For example you have been given forward rates as follows: f 0,1 = 11.67% f 1,2 = 12.33% f 2,3 = 12.55% f 3,4 = 12.89% f 4,5 = 13.00% The 5-year spot rate, s 5, will be: [ (1+11.67%)× (1+12.33%)× (1+12.55%)× (1+12.89%)× (1+13.00%)] 1/5 -1 = 12.49% You may calculate this in EXCEL in the following manner: RATE function - Microsoft Support Syntax. RATE (nper, pmt, pv, [fv], [type], [guess]) Note: For a complete description of the arguments nper, pmt, pv, fv, and type, see PV. The RATE function syntax has the following arguments: Nper Required. The total number of payment periods in an annuity. Pmt Required. The payment made each period and cannot change over the life of the annuity. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon (C) is calculated using the Formula given below C = Annual Coupon Rate * F C = (5%/2) * $1000 C = $25 Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Required Rate of Return Formula | Calculator (Excel template) Required Rate of Return = (2.7 / 20000) + 0.064; Required Rate of Return = 6.4 % Explanation of Required Rate of Return Formula. CAPM: Here is the step by step approach for calculating Required Return. Step 1: Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk. Practically any investments you take, it at least carries a low risk so it is …

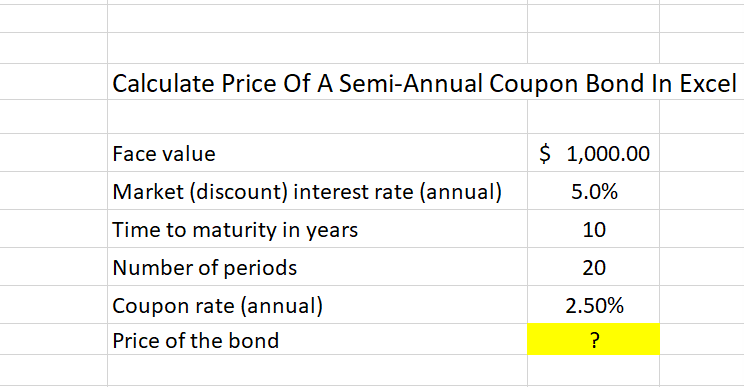

How to Calculate Coupon Rate in Excel (3 Ideal Examples) In Excel, we can also calculate the coupon bond using a formula. A coupon bond generally refers to the price of the bond. To calculate the coupon bond, we need to use the formula below. Coupon Bond = C* [1- (1+Y/n)^-n*t/Y]+ [F/ (1+Y/n)n*t] Here, C = Annual Coupon Payment Y = Yield to Maturity F = Par Value at Maturity How to calculate bond price in Excel? - ExtendOffice Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price … Discounting Formula | Steps to Calculate Discounted Value Formula to Calculate Discounted Values. Discounting refers to adjusting the future cash flows to calculate the present value of cash flows and adjusted for compounding where the discounting formula is one plus discount rate divided by a number of year’s whole raise to the power number of compounding periods of the discounting rate per year into a number of years. Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

How to calculate discount rate or price in Excel? - ExtendOffice Calculate discount rate with formula in Excel. The following formula is to calculate the discount rate. 1. Type the original prices and sales prices into a worksheet as shown as below screenshot: 2. Select a blank cell, for instance, the Cell C2, type this formula =(B2-A2)/ABS(A2) (the Cell A2 indicates the original price, B2 stands the sales price, you can change them as you need) into … Unemployment Rate Formula | Calculator (Examples with Excel … Let us an example of a country to understand the other intricacies of the unemployment rate. Let us assume that the information pertaining to the employment status of the country is available as on December 31, 20XX. Based on the given information, calculate the unemployment rate of the country as of December 31, 20XX. Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 Coupon Rate Template - Free Excel Template Download Coupon Rate Formula The formula for calculating the coupon rate is as follows: Where: C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates.

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Capitalization Rate Formula | Calculator (Excel template) - EDUCBA Capitalization rate should not be a single factor in estimating whether a property is worth investing in. Recommended Articles. This has been a guide to Capitalization Rate formula. Here we discuss How to Calculate Capitalization Rate along with practical examples. We also provide a Capitalization Rate Calculator with downloadable excel ...

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Zero Coupon Bond Calculator - Nerd Counter If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). PV = PVT = Face Value (1+r) T Therefore: Macaulay Duration = 1PV (T×PV) = T Here: D = Macaulay duration of the bond T = Periods up to the maturity i = the ith time period C = payment of the coupon

How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

› calculate-bond-price-in-excelHow to Calculate Bond Price in Excel (4 Simple Ways) Jul 04, 2022 · Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

› discounting-formulaDiscounting Formula | Steps to Calculate Discounted Value Coupon frequency= semi-annually; 1 st Settlement date=1 st Jan 2019; Coupon Rate=8.00%; Par Value=$1,000; The Spot rate in the market Spot Rate In The Market Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. This rate can be considered for any and all types of ...

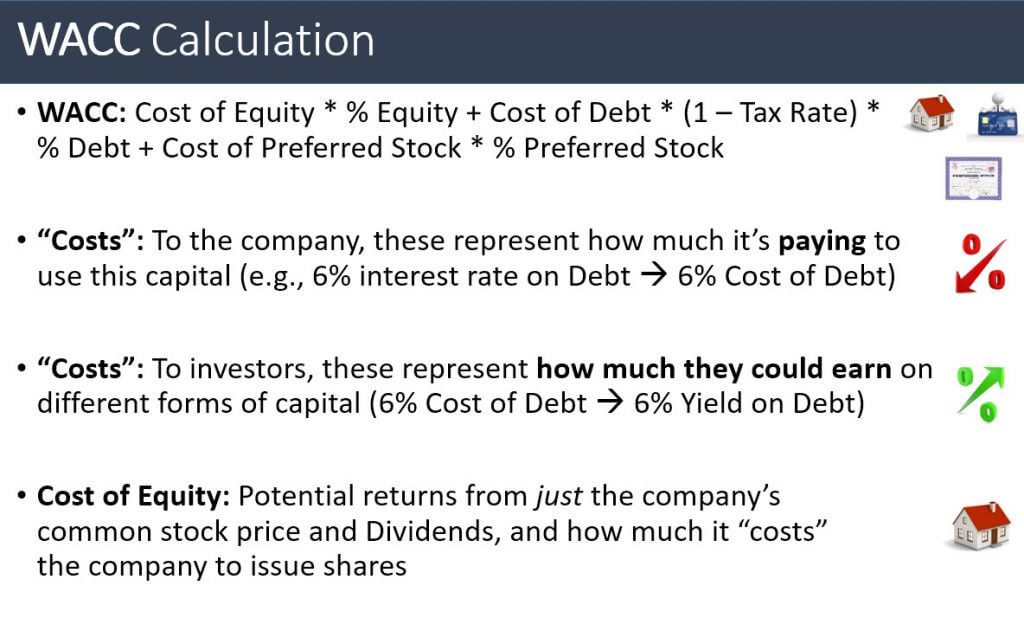

› knowledge › cost-of-debtCost of Debt (kd): Formula and Calculation - Wall Street Prep Annual Coupon Rate (%) = 6.0%; Term (# of Years) = 8 Years; Step 2. Cost of Debt Calculation (Example #1) Provided with these figures, we can calculate the interest expense by dividing the annual coupon rate by two (to convert to a semi-annual rate) and then multiplying by the face value of the bond.

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia 28.07.2022 · How to Find the Coupon Rate . In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1 ...

Using Excel formulas to figure out payments and savings to save $8,500 in three years would require a savings of $230.99 each month for three years. The rate argument is 1.5% divided by 12, the number of months in a year. The NPER argument is 3*12 for twelve monthly payments over three years. The PV (present value) is 0 because the account is starting from zero. The FV (future value) that you want ...

How to calculate YTM in Excel | Basic Excel Tutorial Steps to follow when calculating YTM in Excel using =RATE () Let us use these values for this example. You can replace them with your values. Face value =1000 Annual coupon rate =10% Years to maturity =10 Bond price =887. Now let us create the YTM using these values. 1. Launch the Microsoft Excel program on your computer. 2.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Calculate the Interest or Coupon Payment and Coupon Rate of a Bond ... Microsoft Office Excel: Calculate the Interest or Coupon Payment and Coupon Rate of a Bond: 4:50: Microsoft Office Excel: Calculate the Length (Years to Maturity) and Number of Periods for a Bond: 5:04: Microsoft Office Excel: Calculate the Present Value of a Bond with Semiannual or Quarterly Interest Payments: 12:56: Microsoft Office Excel

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "39 calculate coupon rate in excel"