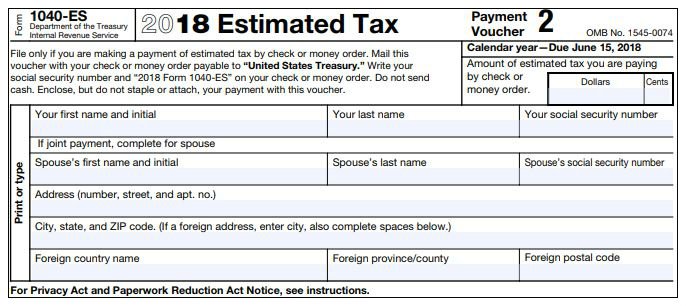

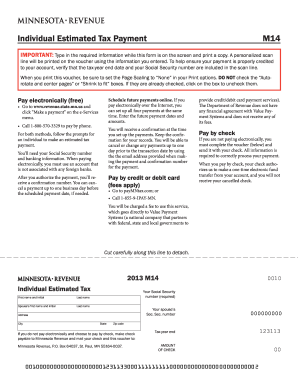

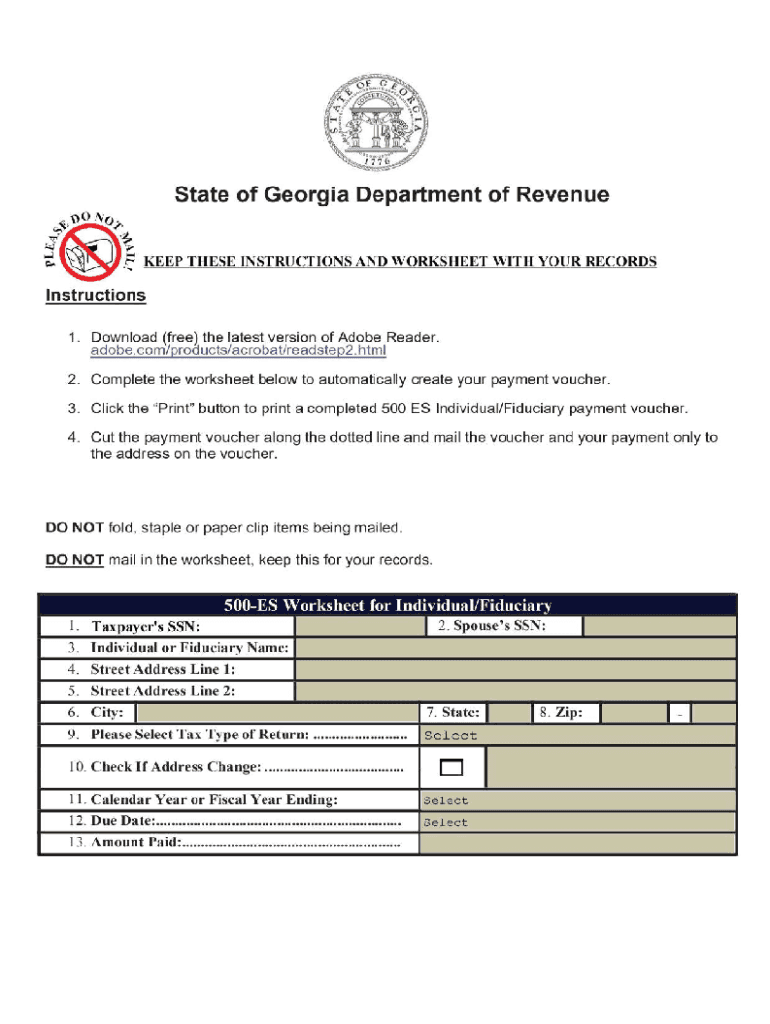

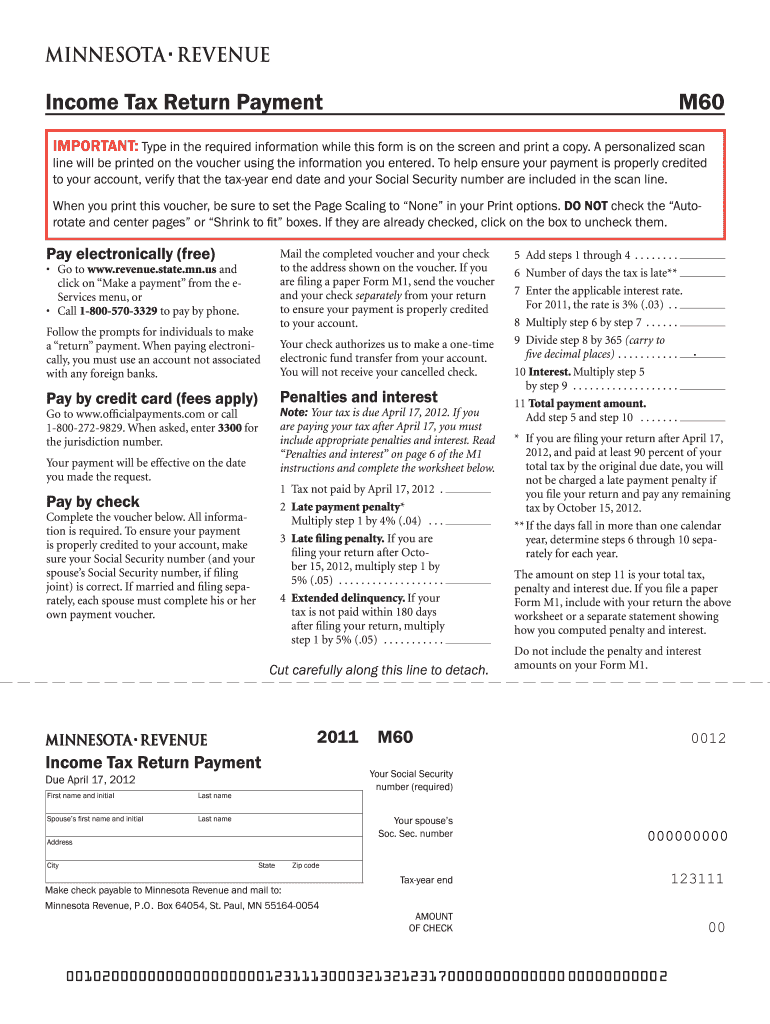

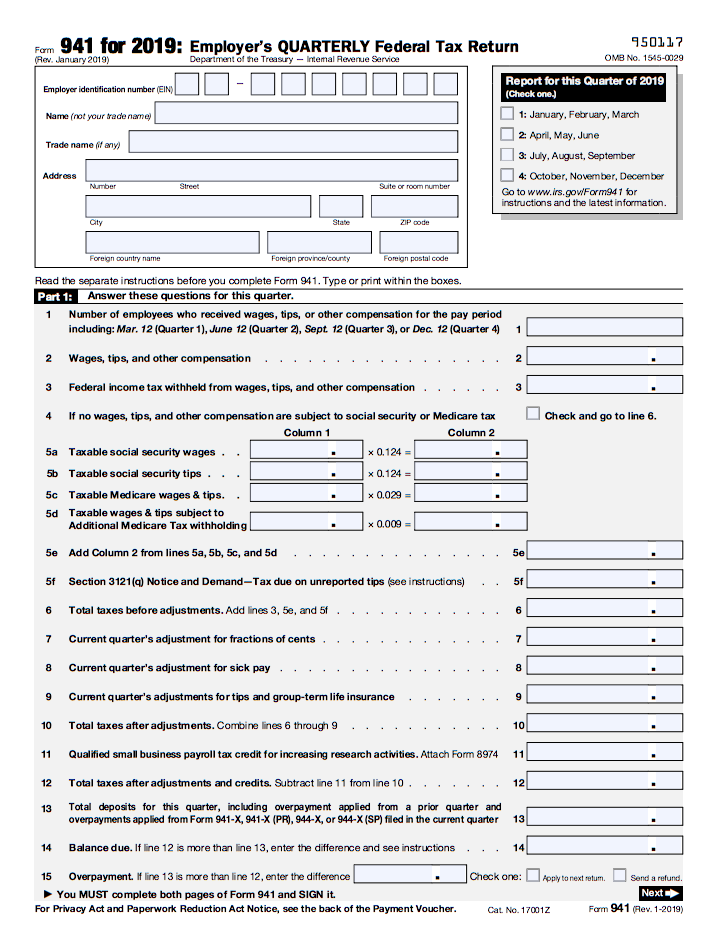

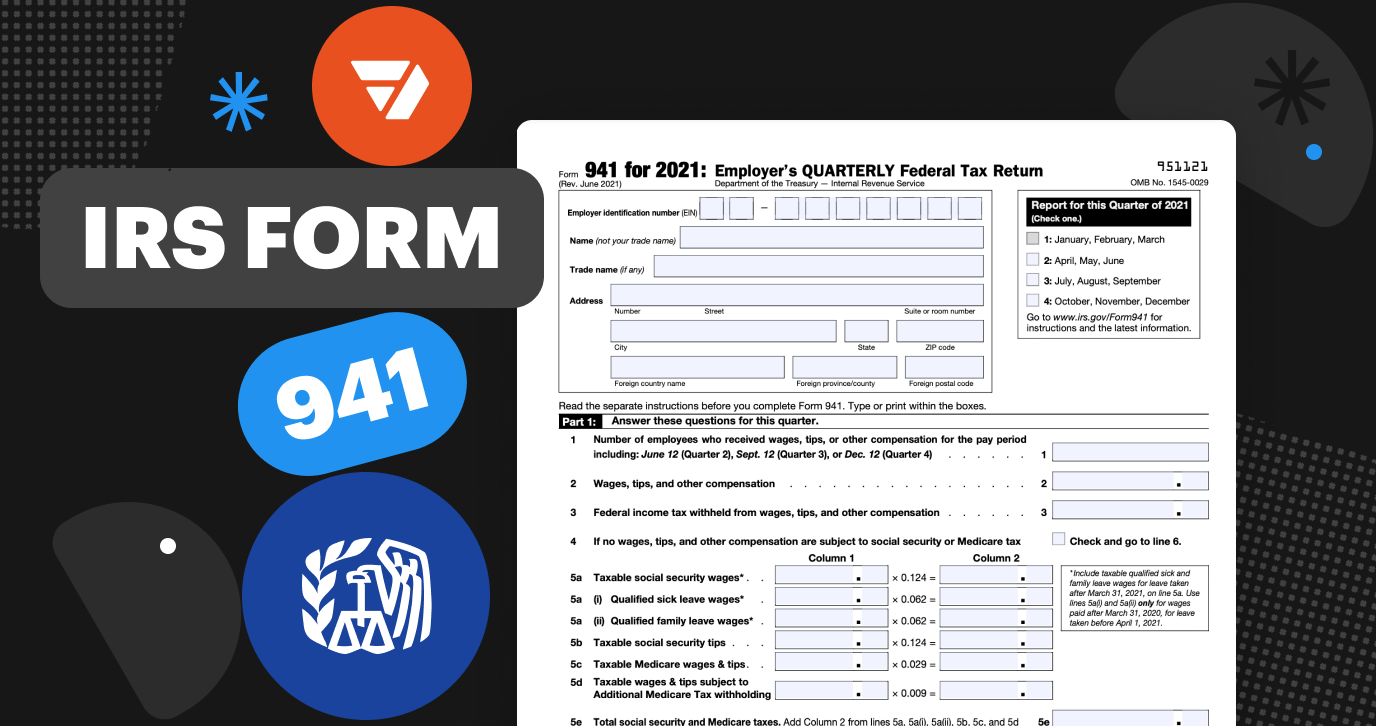

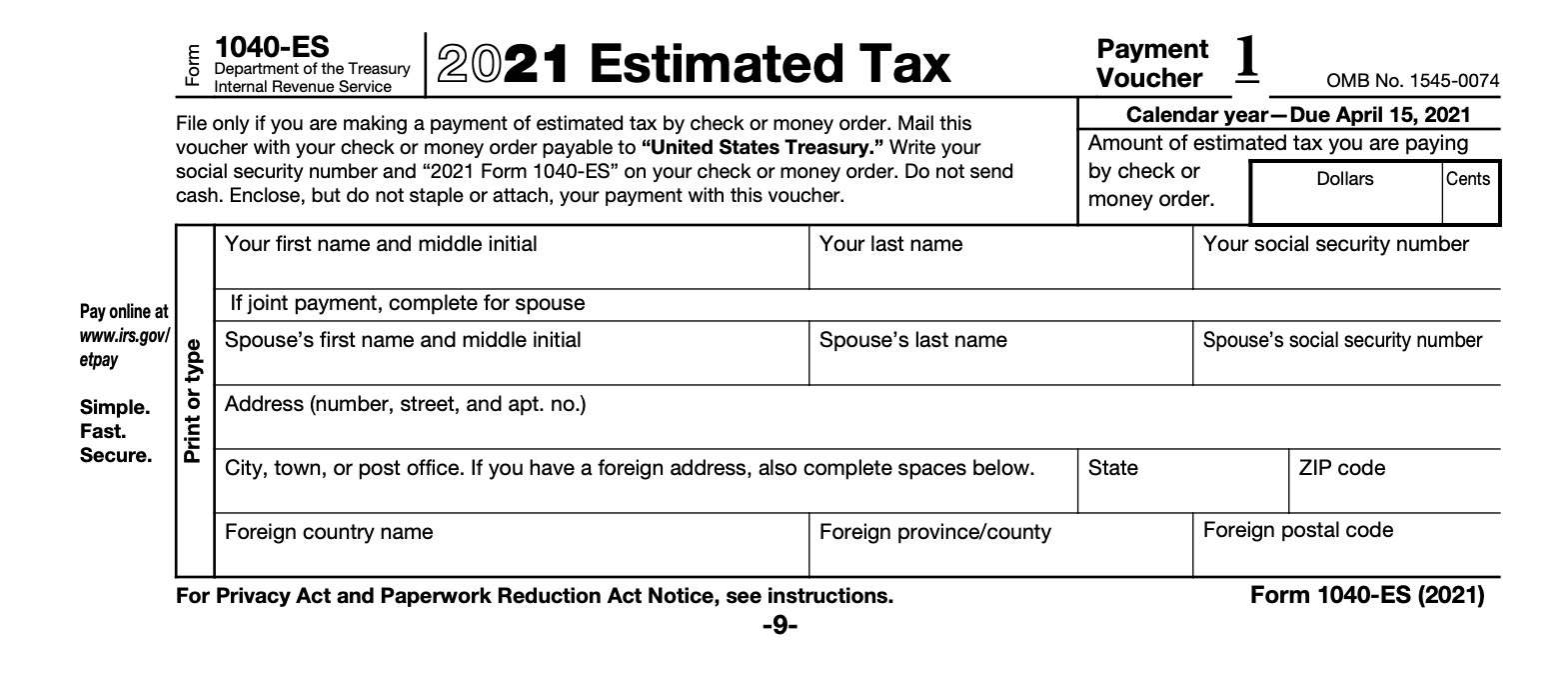

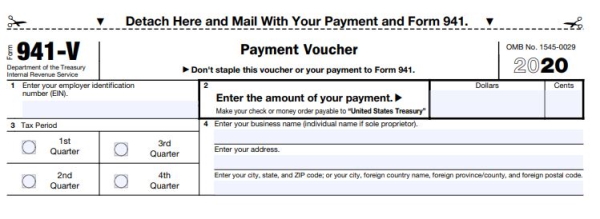

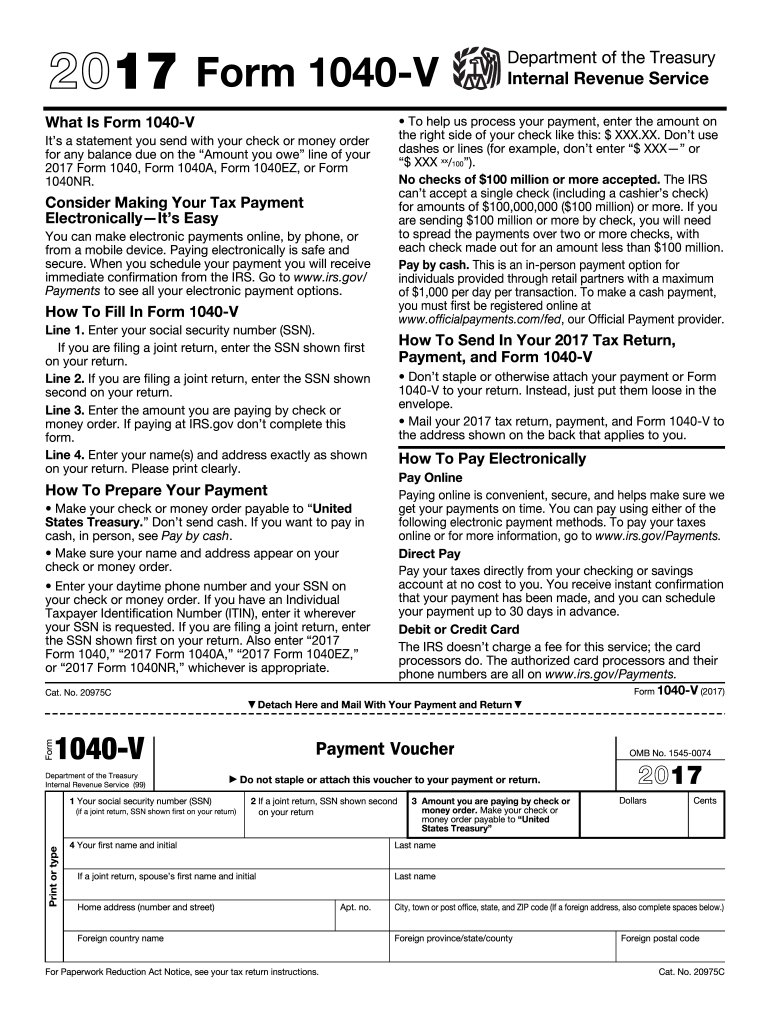

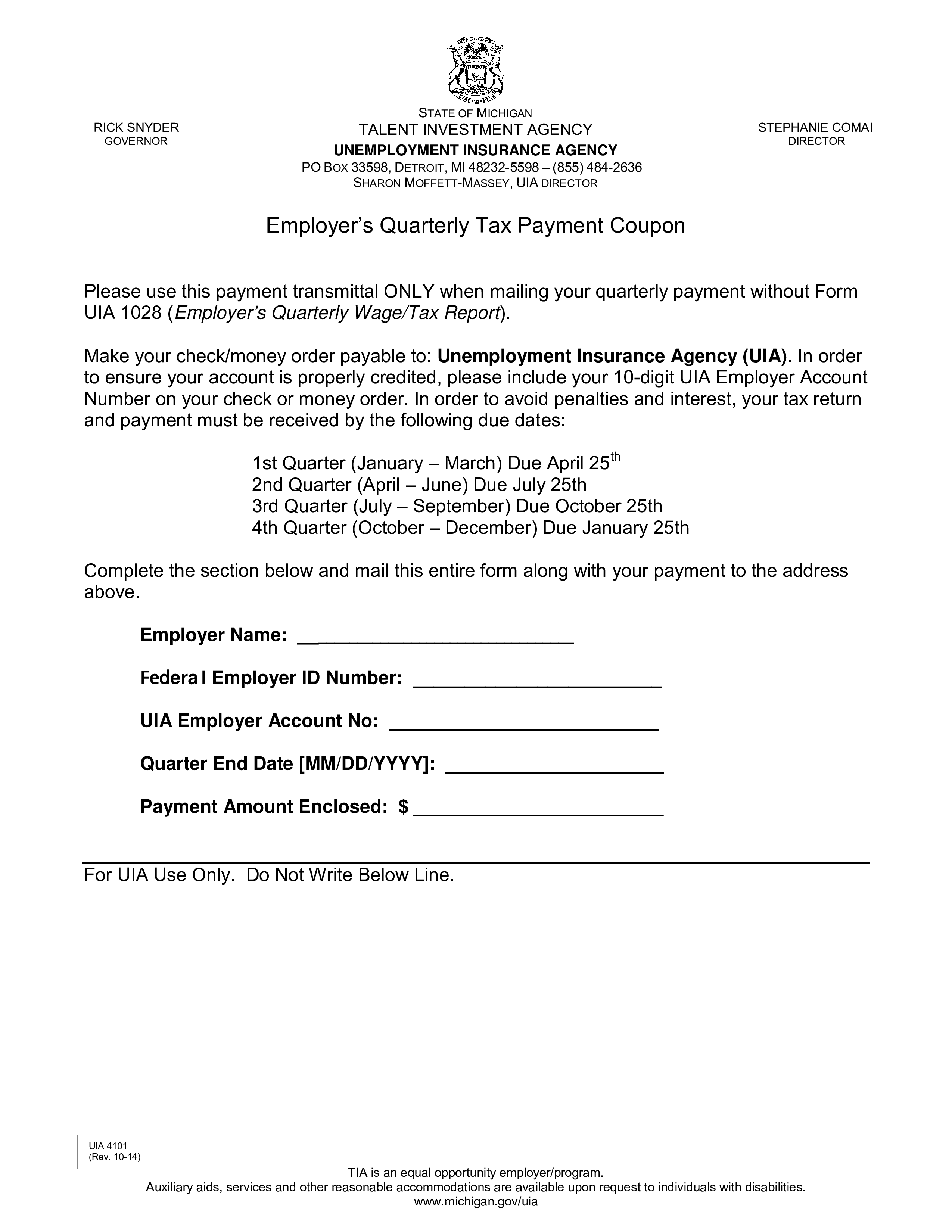

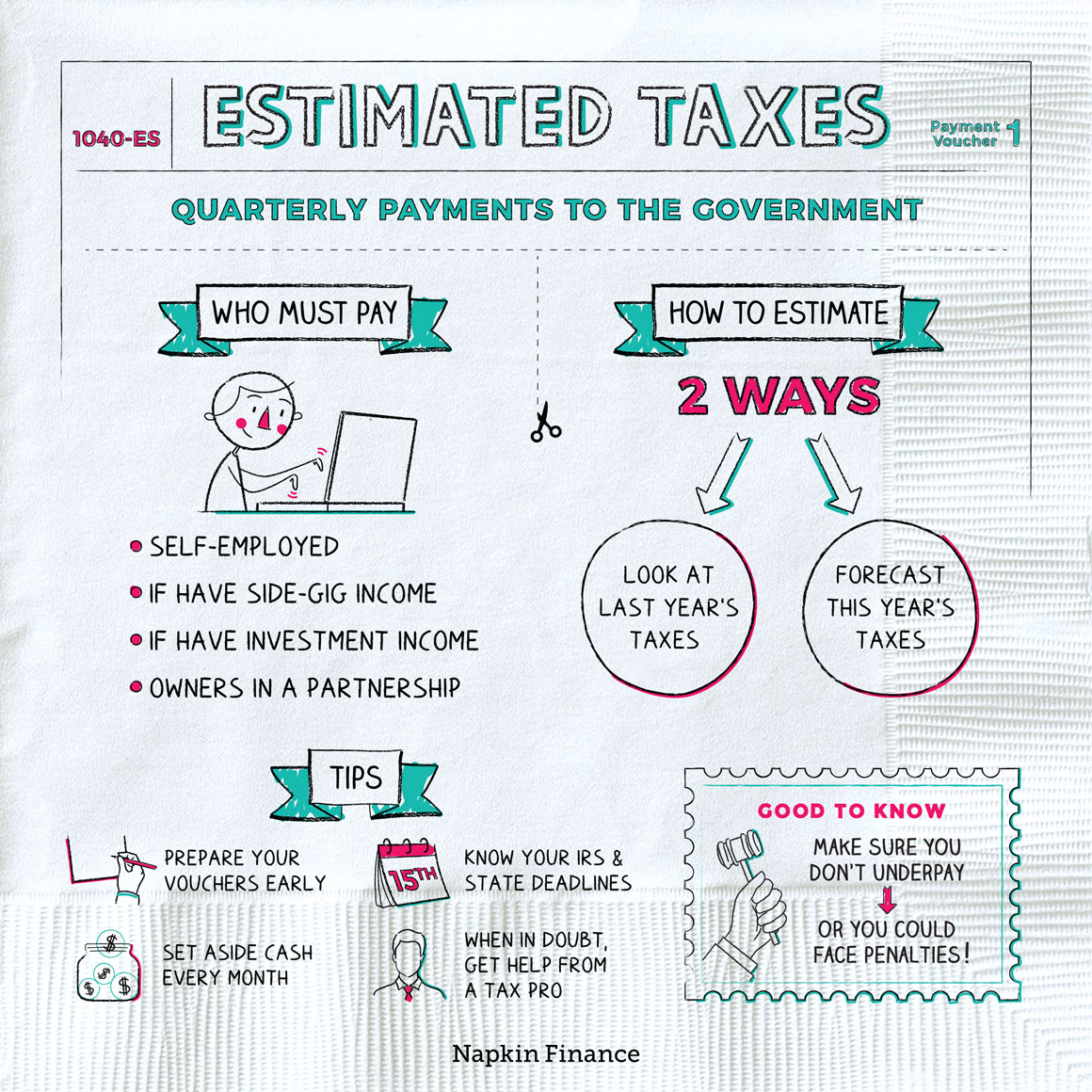

39 irs quarterly payment coupon

Publication 537 (2021), Installment Sales | Internal Revenue ... You sell property for $100,000. The sales agreement calls for a down payment of $10,000 and payment of $15,000 in each of the next 6 years to be made from an irrevocable escrow account containing the balance of the purchase price plus interest. Publication 505 (2022), Tax Withholding and Estimated Tax If a 2022 Form W-4P is used for withholding for payments beginning in 2022, and you don't give the payer your SSN in the required manner or the IRS notifies the payer before any payment or distribution is made that you gave an incorrect SSN, tax will be withheld as if your filing status is single, with no adjustments in Steps 2 through 4.

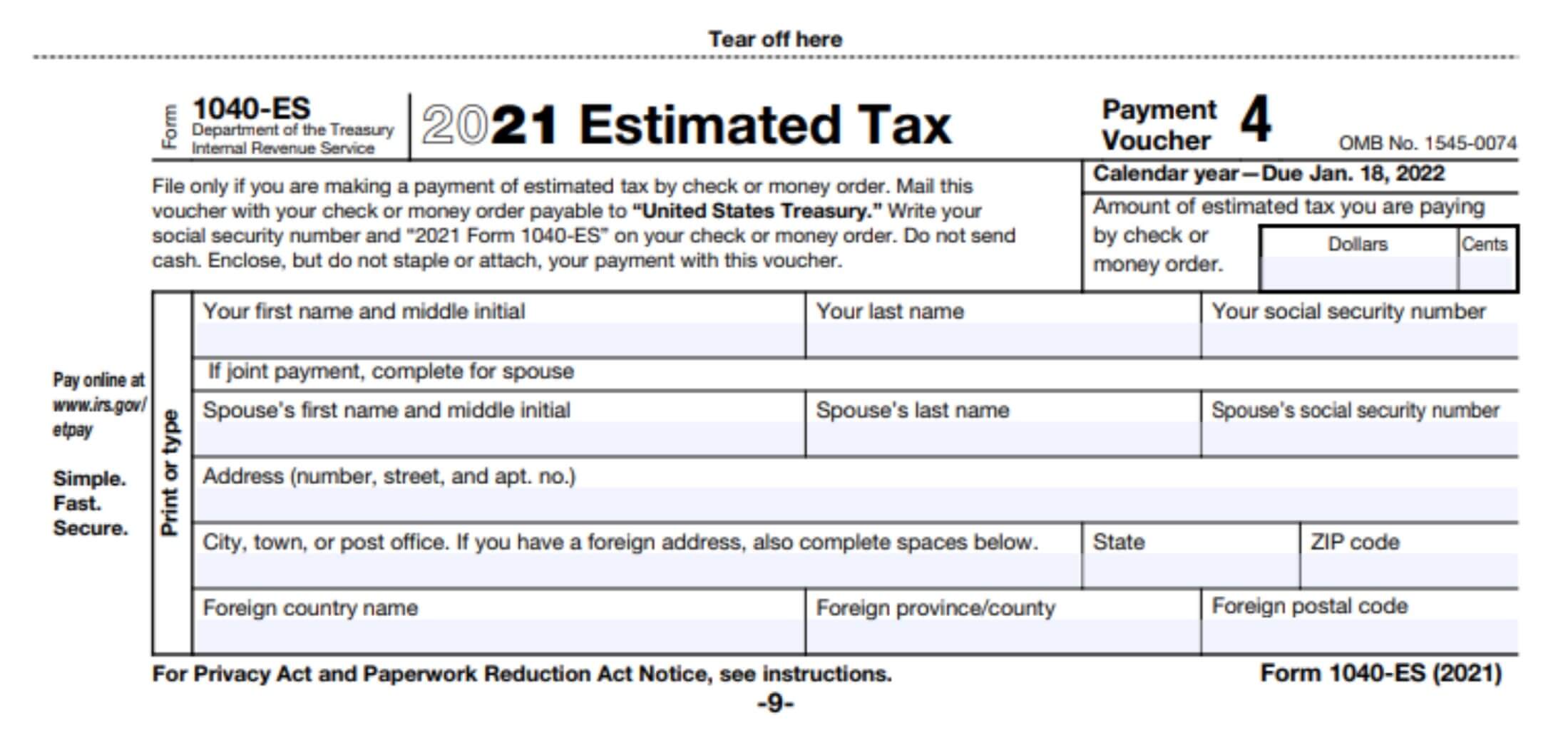

2022 Form 1040-ES - IRS tax forms use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. Select the "balance due" reason for payment or, if paying with a debit or credit card,

Irs quarterly payment coupon

Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online. Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... As a result, a taxpayer may be treated as having received a dividend equivalent payment even if the taxpayer makes a net payment or no amount is paid because the net amount is zero. In 2021, an NPC or ELI will generally be a specified NPC or specified ELI, respectively, if the contract is a delta one transaction. Publication 15 (2022), (Circular E), Employer's Tax Guide Paying the deferred amount of the employer share of social security tax. The CARES Act allowed employers to defer the deposit and payment of the employer share of social security tax. The deferred amount of the employer share of social security tax was only available for deposits due on or after March 27, 2020, and before January 1, 2021, as well as deposits and payments due after January 1 ...

Irs quarterly payment coupon. Payments | Internal Revenue Service - IRS tax forms Oct 04, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Publication 15 (2022), (Circular E), Employer's Tax Guide Paying the deferred amount of the employer share of social security tax. The CARES Act allowed employers to defer the deposit and payment of the employer share of social security tax. The deferred amount of the employer share of social security tax was only available for deposits due on or after March 27, 2020, and before January 1, 2021, as well as deposits and payments due after January 1 ... Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... As a result, a taxpayer may be treated as having received a dividend equivalent payment even if the taxpayer makes a net payment or no amount is paid because the net amount is zero. In 2021, an NPC or ELI will generally be a specified NPC or specified ELI, respectively, if the contract is a delta one transaction. Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Post a Comment for "39 irs quarterly payment coupon"