42 difference between coupon rate and market rate

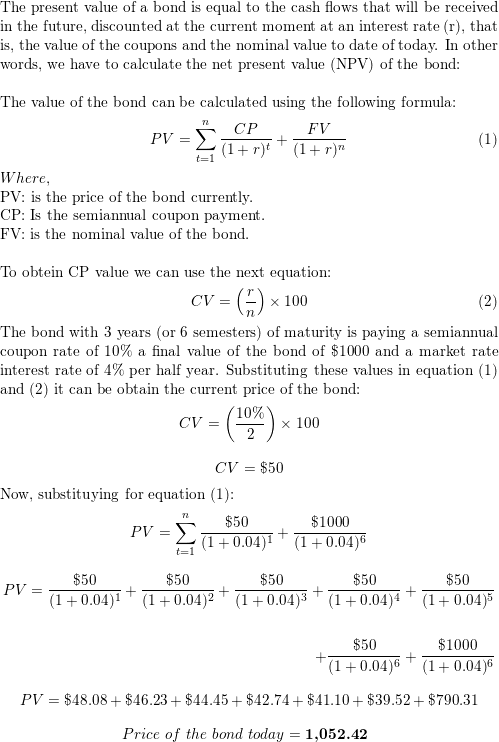

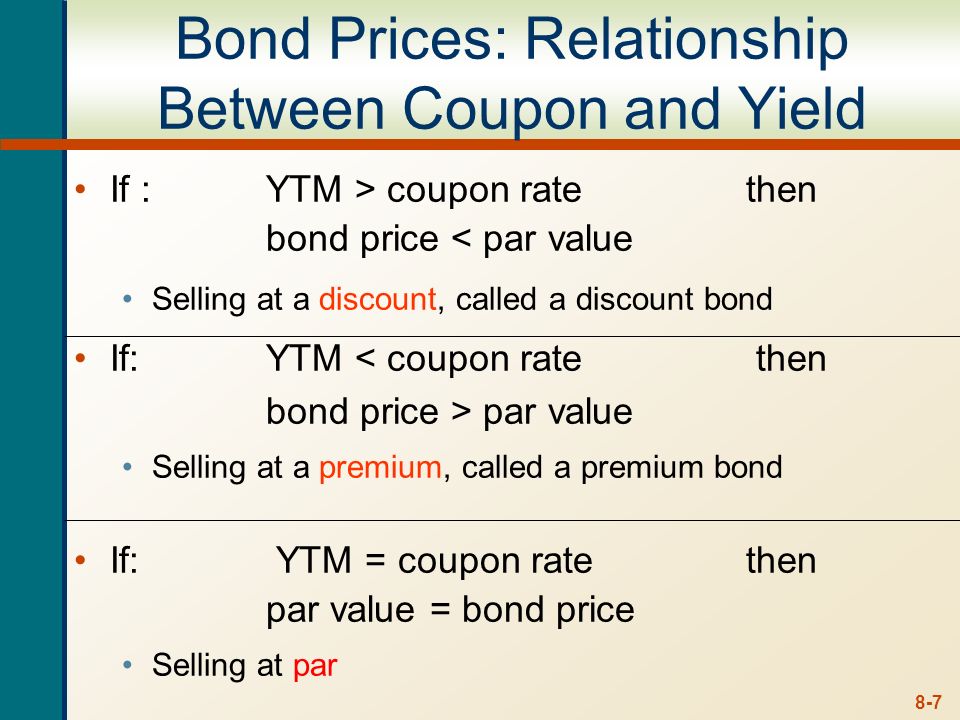

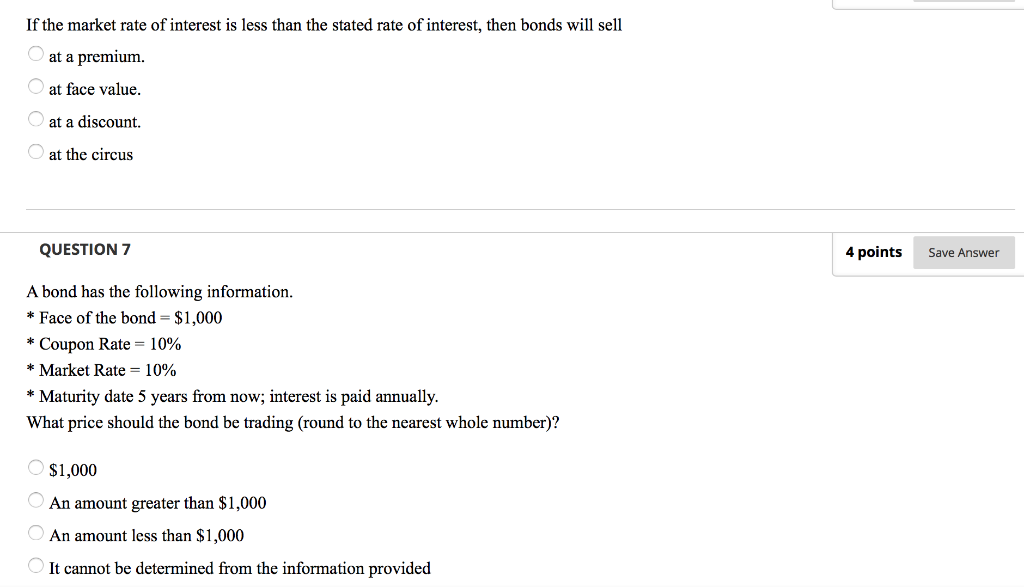

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%.... Coupon Rate Definition - Investopedia Market interest rates change over time and as they move lower or higher than a bond's coupon rate, the value of the bond increases or decreases, respectively. Since a bond's coupon rate is...

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Difference between coupon rate and market rate

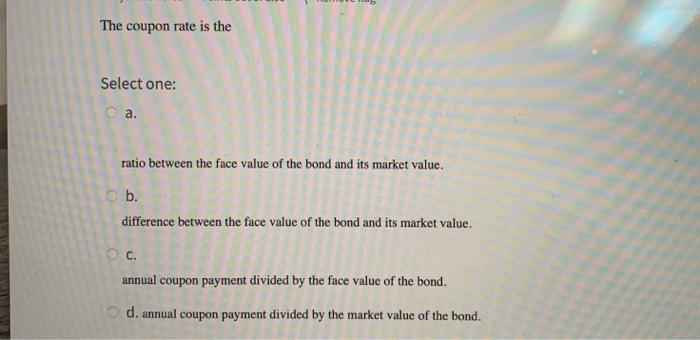

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia It is the sum of all of its remaining coupon payments. A bond's yield to maturity rises or falls depending on its market value and how many payments remain to be made. The coupon rate is the... Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ... Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender.

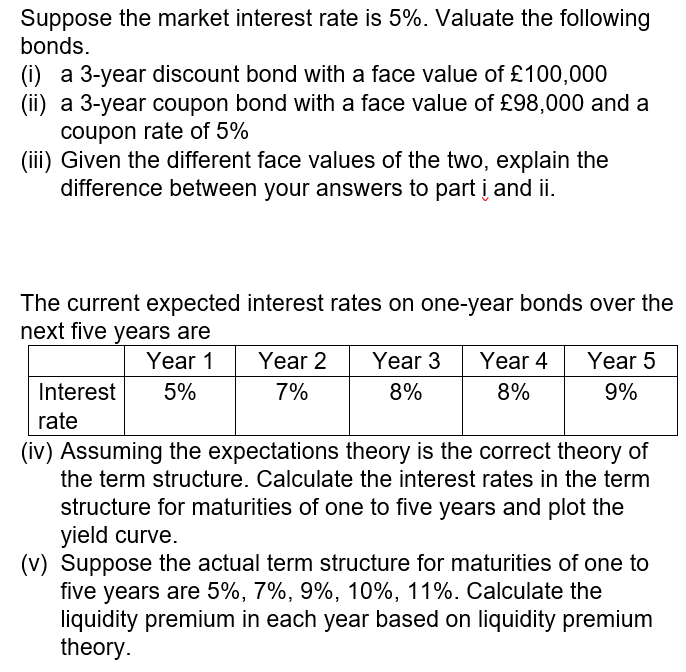

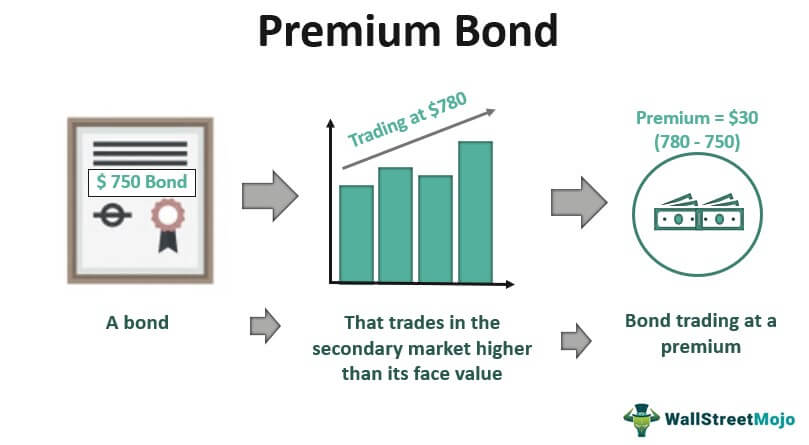

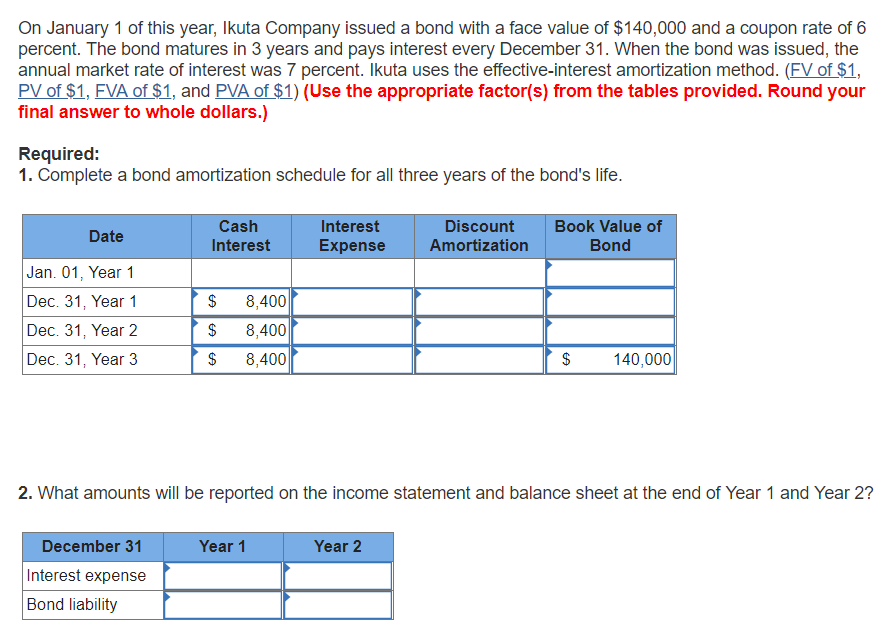

Difference between coupon rate and market rate. The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary What is the difference between coupon rate and market - Course Hero The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money. Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features. Difference between Yield Coupon Rate - Difference Betweenz The coupon rate is one factor that helps them determine how much income a bond will generate. Other factors include the length of time until the bond matures and market conditions. For example, when interest rates rise, newly issued bonds will have higher coupon rates than existing bonds. Difference between Yield Coupon Rate

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The coupon rate is decided by the issuer of the bonds to the purchaser. The interest rate is decided by the lender. Coupon rates are largely affected by the interest rates decided by the government. If the interest rates are set to 6%, then no investor will accept the bonds offering coupon rate lower than this. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... Difference between YTM and Coupon Rates where "Coupon Payment" is the periodic interest payment made by the issuer, "Par Value" is the face value of the bond that's paid at maturity, "Market Price" is the current price of the bond, and "n" is the number of years until maturity. What is the Coupon Rate?

Difference Between Coupon Rate and Interest Rate - diffzy.com The critical difference between coupon rate and interest rate is that interest rate is a fixed rate throughout the life of the investment, while the coupon rate changes from time to time, depending upon market conditions. The coupon rate is always estimated on the par value/ face value of the investment. Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate. What is the difference between the coupon rate and the current market ... Basically, what drives these market powers is the contrast between the current market interest for investments of a similar risk level as the security, and the bond's own coupon rate. Hence if a security has a coupon rate underneath current market interest rates, its reasonable worth will be beneath its face value of $1,000 and the other way ... Difference Between Discount Rate and Interest Rate Interest rates and discount rates are rates that apply to borrowers and savers who pay or receive interest for savings or loans. Interest rates are determined by the market interest rate and other factors that need to be considered, especially, when lending funds. Discount rates refer to two different things. While discount rates are the rates ...

Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ...

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia It is the sum of all of its remaining coupon payments. A bond's yield to maturity rises or falls depending on its market value and how many payments remain to be made. The coupon rate is the...

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Post a Comment for "42 difference between coupon rate and market rate"